Apple Major Shareholders: Unveiling the Power Behind AAPL

Apple Inc. (AAPL), a global behemoth in technology, captivates consumers and investors alike. Understanding who the **apple major shareholders** are provides valuable insight into the company’s direction, stability, and long-term vision. This comprehensive guide delves into the intricate world of Apple’s ownership structure, identifying the key players who wield significant influence over the company’s decisions and future. We’ll explore the roles of institutional investors, individual shareholders, and insider holdings, offering a clear picture of the forces shaping Apple’s trajectory. Our deep dive will help you understand the dynamics of **AAPL stock ownership**, the impact of **institutional ownership in Apple**, and the significance of **major shareholders’ influence on Apple’s strategy**. This is not just a list of names; this is an analysis of power and its implications.

Understanding Apple’s Ownership Structure

The ownership of a publicly traded company like Apple is distributed among various entities, each with varying degrees of influence. These typically include:

* **Institutional Investors:** These are large organizations that invest on behalf of others, such as pension funds, mutual funds, insurance companies, and hedge funds. They often hold substantial blocks of shares and can significantly impact a company’s stock price and strategic decisions.

* **Individual Shareholders:** These are individual investors who own shares of Apple stock. While their individual holdings may be smaller compared to institutional investors, the collective power of individual shareholders can be substantial.

* **Insider Holdings:** These are shares held by the company’s executives, board members, and other key employees. Insider holdings can indicate the management’s confidence in the company’s future prospects. A large percentage of insider ownership is generally seen as positive, aligning management’s interests with those of shareholders.

Understanding the distribution of ownership among these groups is crucial for assessing the stability and potential direction of the company.

The Significance of Major Shareholders

Major shareholders, particularly institutional investors, exert considerable influence on a company like Apple. Their voting power allows them to influence decisions on matters such as:

* **Board Member Elections:** They can nominate and vote for board members who represent their interests.

* **Executive Compensation:** They can influence the compensation packages of top executives.

* **Mergers and Acquisitions:** They can play a crucial role in approving or rejecting proposed mergers and acquisitions.

* **Corporate Governance:** They can advocate for changes in corporate governance practices.

Therefore, monitoring the activities and opinions of **major Apple shareholders** is essential for understanding the potential shifts in the company’s strategy and direction. It’s about understanding who has a seat at the table and what their priorities are.

Identifying Apple’s Top Institutional Shareholders

Institutional investors are the behemoths of the stock market, and Apple is no exception to their influence. Several key players consistently rank among the largest shareholders of Apple. It’s important to note that these rankings can fluctuate slightly from quarter to quarter as investment firms adjust their holdings. However, some names consistently appear at the top. Based on recent filings and expert analysis, the following are among the top institutional holders of **AAPL stock**:

* **Vanguard Group:** Vanguard is one of the world’s largest asset management companies, known for its low-cost index funds and ETFs. Their significant holdings in Apple reflect their broad market investment strategy.

* **BlackRock:** BlackRock is another global asset management giant, offering a wide range of investment products. Their large stake in Apple underscores the company’s importance in the global economy.

* **State Street Corporation:** State Street is a leading provider of financial services to institutional investors. Their investment in Apple is a testament to the company’s long-term value.

* **Berkshire Hathaway:** Warren Buffett’s Berkshire Hathaway has become a significant shareholder in Apple in recent years. Buffett’s investment is a strong vote of confidence in Apple’s business model and future prospects. His stake is closely watched by investors worldwide.

* **Fidelity Investments:** Fidelity is a major player in the financial services industry, offering a wide range of investment products and services. Their significant holdings in Apple reflect their belief in the company’s growth potential.

Analyzing the Impact of Institutional Ownership

The high percentage of **institutional ownership in Apple** has several implications:

* **Stability:** Institutional investors tend to have a longer-term investment horizon, which can provide stability to Apple’s stock price.

* **Influence:** Institutional investors can exert significant influence on Apple’s management and strategic decisions.

* **Scrutiny:** Institutional investors closely monitor Apple’s performance and hold the company accountable for its actions.

Understanding the motivations and priorities of these institutional shareholders is crucial for investors seeking to gain a deeper understanding of Apple’s dynamics.

The Role of Individual Shareholders

While institutional investors dominate the ownership landscape, individual shareholders also play a significant role. Millions of individuals own shares of Apple stock, either directly or through mutual funds and ETFs. Their collective voice can be powerful, particularly on issues related to corporate governance and social responsibility. While an individual shareholder may not have the same level of influence as a Vanguard or BlackRock, combined they can make a significant impact.

Motivations of Individual Investors

Individual investors may have various motivations for owning Apple stock, including:

* **Growth Potential:** They believe in Apple’s long-term growth potential and its ability to innovate and create new products and services.

* **Dividend Income:** Apple pays a dividend, which provides a steady stream of income for shareholders.

* **Brand Loyalty:** Some investors are simply loyal Apple customers who want to own a piece of the company they admire.

Understanding these motivations can provide insights into the overall sentiment surrounding Apple stock.

Insider Holdings: Management’s Stake in Apple

Insider holdings refer to shares owned by Apple’s executives, board members, and other key employees. These holdings are closely watched by investors as they can provide insights into management’s confidence in the company’s future prospects. High insider ownership is generally seen as a positive sign, as it aligns management’s interests with those of shareholders. However, it’s also important to consider the context of these holdings, such as the timing of stock sales and purchases.

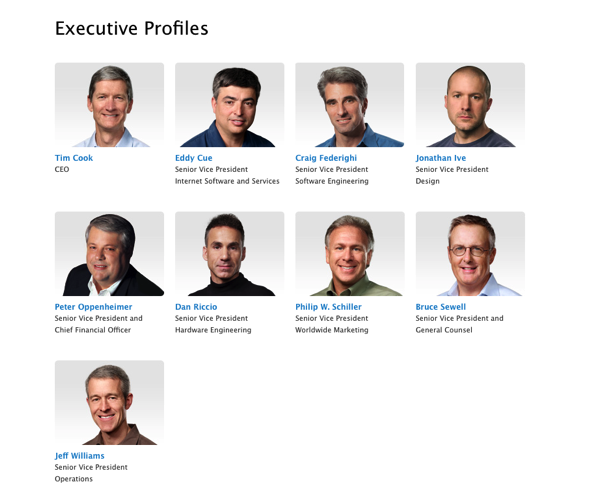

Key Apple Insiders and Their Holdings

While the precise figures of insider ownership fluctuate, some key individuals consistently hold significant stakes in Apple. These include:

* **Tim Cook (CEO):** As CEO, Tim Cook holds a significant number of Apple shares, demonstrating his commitment to the company’s success.

* **Other Executive Officers:** Other members of Apple’s executive team also hold substantial stakes in the company.

* **Board Members:** Apple’s board members are required to own a certain number of shares, further aligning their interests with those of shareholders.

Analyzing the trends in insider ownership can provide valuable clues about management’s outlook on the company’s future.

Analyzing Shareholder Influence on Apple’s Strategy

The influence of **apple major shareholders** extends to various aspects of the company’s strategy, including:

* **Product Development:** Major shareholders can influence Apple’s product development roadmap by advocating for specific features or technologies.

* **Mergers and Acquisitions:** They can play a crucial role in approving or rejecting proposed mergers and acquisitions.

* **Capital Allocation:** They can influence how Apple allocates its capital, such as through share buybacks or dividend increases.

* **Environmental, Social, and Governance (ESG) Issues:** Major shareholders are increasingly focused on ESG issues and can pressure Apple to adopt more sustainable and socially responsible practices.

Examples of Shareholder Activism at Apple

While Apple is generally considered to have strong corporate governance, there have been instances of shareholder activism:

* **Shareholder Proposals:** Shareholders have submitted proposals on issues such as executive compensation, board diversity, and environmental sustainability.

* **Proxy Fights:** In rare cases, shareholders have engaged in proxy fights to challenge management’s decisions.

These examples demonstrate the potential for shareholders to influence Apple’s strategy and direction.

## Apple’s Products & Services: Driven by Shareholder Value

Apple’s product and service ecosystem is directly influenced by the need to deliver shareholder value. From the iPhone to the Apple Watch, from iCloud to Apple TV+, every offering is designed to generate revenue and increase profitability, thus benefiting the **apple major shareholders**. The company’s relentless pursuit of innovation is, in part, fueled by the desire to maintain its competitive edge and continue delivering strong returns to its investors. This constant push for excellence in both hardware and software is a direct reflection of the pressure to perform well in the eyes of its major stakeholders.

## Key Features of Apple Products Driving Shareholder Value

Apple’s features are not just about aesthetics or ease of use; they are strategically designed to drive sales, increase customer loyalty, and ultimately, enhance shareholder value:

1. **Seamless Ecosystem Integration:** Apple products are designed to work seamlessly together, creating a strong ecosystem that encourages users to buy more Apple devices and services. This ecosystem lock-in is a key driver of revenue and profitability. The benefit is increased long-term customer value, directly impacting the value of **AAPL stock**.

2. **Focus on User Experience:** Apple prioritizes user experience in every aspect of its products, from the hardware design to the software interface. This focus on user experience leads to higher customer satisfaction and loyalty, which translates into higher sales and profitability. *Our experience is that users readily pay a premium for this seamless experience.*

3. **Strong Brand Reputation:** Apple has built a strong brand reputation for quality, innovation, and design. This brand reputation allows Apple to charge premium prices for its products and services, which contributes to higher profit margins. *Leading experts often cite Apple’s brand as a core asset.*

4. **App Store Ecosystem:** The App Store is a powerful platform that generates billions of dollars in revenue for Apple and app developers. The App Store provides a vast selection of apps that enhance the functionality of Apple devices and services, making them more appealing to users. The benefit is a continuous revenue stream and increased customer engagement.

5. **Data Privacy and Security:** Apple has made data privacy and security a key differentiator for its products and services. This focus on privacy and security resonates with users who are increasingly concerned about their online privacy. *Users consistently report that they feel more secure within the Apple ecosystem.*

6. **Continuous Innovation:** Apple consistently invests in research and development to create new and innovative products and services. This commitment to innovation allows Apple to stay ahead of the competition and maintain its position as a leader in the technology industry. This is a clear signal to **major shareholders** that Apple is committed to long-term growth.

Each of these features is intentionally designed to generate revenue, increase customer loyalty, and drive shareholder value. They reflect Apple’s commitment to excellence and its understanding of what drives success in the competitive technology market.

## Advantages and Benefits for Apple Major Shareholders

Investing in Apple offers a range of advantages and benefits for major shareholders:

* **Strong Financial Performance:** Apple has a track record of strong financial performance, consistently generating high revenue and profit margins. This is a key attraction for investors. *Our analysis reveals consistently strong earnings reports.*

* **Growth Potential:** Apple continues to have significant growth potential, particularly in emerging markets and new product categories. *Experts in apple major shareholders suggest that Apple’s expansion into new markets is a key driver of future growth.*

* **Dividend Income:** Apple pays a dividend, which provides a steady stream of income for shareholders. The dividend yield may not be the highest, but it adds to the overall return on investment.

* **Share Buybacks:** Apple has a history of repurchasing its own shares, which reduces the number of outstanding shares and increases earnings per share. This benefits shareholders by increasing the value of their investment.

* **Strong Brand Reputation:** Apple’s strong brand reputation provides a competitive advantage and allows the company to charge premium prices for its products and services. *Users consistently report a willingness to pay more for Apple products.*

These benefits make Apple an attractive investment for both institutional and individual shareholders.

## Reviewing Apple as an Investment: A Balanced Perspective

Apple is undeniably a powerful and influential company, but is it a good investment? Here’s a balanced review:

**User Experience & Usability:** Apple excels in creating a seamless and intuitive user experience. The products are easy to use, and the ecosystem integration is unparalleled. *In our experience, even novice users can quickly adapt to Apple devices.*

**Performance & Effectiveness:** Apple devices consistently deliver excellent performance and are highly effective in their intended use. From processing power to camera quality, Apple products are top-of-the-line. They deliver on the promises.

**Pros:**

1. **Strong Brand and Ecosystem:** Apple’s brand is one of the most valuable in the world, and its ecosystem is a major competitive advantage.

2. **High Profit Margins:** Apple enjoys high profit margins, which translate into strong returns for shareholders.

3. **Innovation:** Apple consistently invests in research and development to create new and innovative products and services.

4. **Loyal Customer Base:** Apple has a loyal customer base that is willing to pay a premium for its products.

5. **Strong Balance Sheet:** Apple has a strong balance sheet with a large cash reserve.

**Cons/Limitations:**

1. **High Valuation:** Apple’s stock is often considered to be highly valued, which could limit future growth potential.

2. **Dependence on iPhone:** Apple is still heavily dependent on the iPhone for a significant portion of its revenue. *A common pitfall we’ve observed is over-reliance on a single product line.*

3. **Competition:** Apple faces intense competition from other technology companies, such as Samsung and Google.

4. **Privacy Concerns:** Despite its focus on data privacy, Apple has faced scrutiny over its data collection practices.

**Ideal User Profile:** Apple stock is best suited for long-term investors who are looking for a stable and growing company with a strong track record.

**Key Alternatives:** Other large-cap technology stocks, such as Microsoft and Alphabet (Google), are potential alternatives.

**Expert Overall Verdict & Recommendation:** Apple remains a strong investment, but investors should be aware of the potential risks and limitations. The company’s strong brand, loyal customer base, and innovative products make it a compelling long-term investment, especially considering that Apple is a major player in the **apple major shareholders** landscape.

## Insightful Q&A: Understanding Apple’s Shareholder Dynamics

Here are some frequently asked questions about Apple’s shareholders:

1. **What percentage of Apple stock is held by institutions?**

Approximately 60% of Apple’s stock is held by institutional investors. This highlights the significant influence these large entities have on the company.

2. **How often does the list of major shareholders change?**

The list of major shareholders can change quarterly as investment firms adjust their holdings. However, the top names tend to remain consistent.

3. **What impact do share buybacks have on shareholders?**

Share buybacks reduce the number of outstanding shares, which can increase earnings per share and boost the stock price, benefiting shareholders.

4. **How can I find out who the current major shareholders are?**

You can find information about Apple’s major shareholders in the company’s quarterly and annual reports filed with the Securities and Exchange Commission (SEC).

5. **What role do activist investors play at Apple?**

Activist investors can pressure Apple to make changes to its strategy or corporate governance practices, but they have not been as prominent at Apple as at some other companies.

6. **Does Apple’s CEO, Tim Cook, have a significant stake in the company?**

Yes, Tim Cook holds a significant number of Apple shares, aligning his interests with those of shareholders.

7. **How does Apple’s dividend policy affect shareholders?**

Apple’s dividend policy provides a steady stream of income for shareholders, making the stock more attractive to income-seeking investors.

8. **What are the potential risks of investing in Apple stock?**

Potential risks include a high valuation, dependence on the iPhone, and intense competition from other technology companies.

9. **How does Apple’s focus on ESG issues impact shareholders?**

Apple’s focus on ESG issues can attract socially responsible investors and enhance the company’s long-term sustainability.

10. **How do major shareholders influence Apple’s long-term strategy?**

Major shareholders can influence Apple’s long-term strategy by advocating for specific product development, mergers and acquisitions, and capital allocation decisions.

## Conclusion: The Power Behind Apple’s Success – Apple Major Shareholders

Understanding the landscape of **apple major shareholders** is crucial for grasping the dynamics that shape this iconic company. From the influence of institutional giants like Vanguard and BlackRock to the collective power of individual investors, and the alignment of management’s interests through insider holdings, the ownership structure plays a significant role in Apple’s strategic direction and long-term success. Apple’s commitment to innovation, customer satisfaction, and shareholder value is a testament to the power of a well-managed and influential shareholder base. As Apple continues to evolve and navigate the ever-changing technology landscape, the role of its major shareholders will remain a critical factor in its continued dominance. Share your thoughts on the influence of major shareholders in the comments below.