Apple Major Shareholders: Unveiling the Power Brokers Behind AAPL

Are you curious about who wields the most influence at Apple, one of the world’s most valuable companies? Understanding the landscape of Apple major shareholders is crucial for investors, industry analysts, and anyone interested in corporate governance. This comprehensive guide delves deep into the ownership structure of Apple (AAPL), identifying the key players and exploring the implications of their holdings. We go beyond simple lists, providing insightful analysis and context you won’t find elsewhere. You’ll gain a clear understanding of who truly controls Apple and how their decisions can impact the company’s future. This analysis draws on publicly available information and expert interpretations to provide a reliable and insightful overview of Apple’s ownership.

Understanding Apple’s Shareholder Structure

The ownership of a publicly traded company like Apple is distributed among numerous shareholders, ranging from individual investors to large institutional entities. However, a significant portion of the company’s shares is typically held by a relatively small number of major shareholders. These shareholders, due to the size of their holdings, exert considerable influence on the company’s strategic direction and corporate governance. Understanding this structure is essential for evaluating the potential impact of shareholder actions on Apple’s performance.

The Significance of Major Shareholders

Major shareholders play a vital role in shaping a company’s trajectory. Their voting power allows them to influence key decisions, such as the election of board members, approval of executive compensation packages, and strategic mergers and acquisitions. The interests and priorities of major shareholders can therefore significantly impact a company’s policies and overall performance. Identifying these key players and understanding their motivations is crucial for anyone seeking to understand the inner workings of Apple.

Types of Apple Major Shareholders

Apple’s major shareholders typically fall into several categories:

* **Institutional Investors:** These are large financial institutions, such as mutual funds, pension funds, hedge funds, and insurance companies, that manage vast sums of money on behalf of their clients.

* **Individual Investors:** These are individuals who own a significant number of Apple shares, often company founders, executives, or early investors.

* **Index Funds:** These are passively managed funds that aim to replicate the performance of a specific market index, such as the S&P 500. Because Apple is a major component of these indices, index funds hold a significant number of Apple shares.

* **Sovereign Wealth Funds:** These are investment funds owned by governments, often investing in a diversified portfolio of assets, including publicly traded companies like Apple.

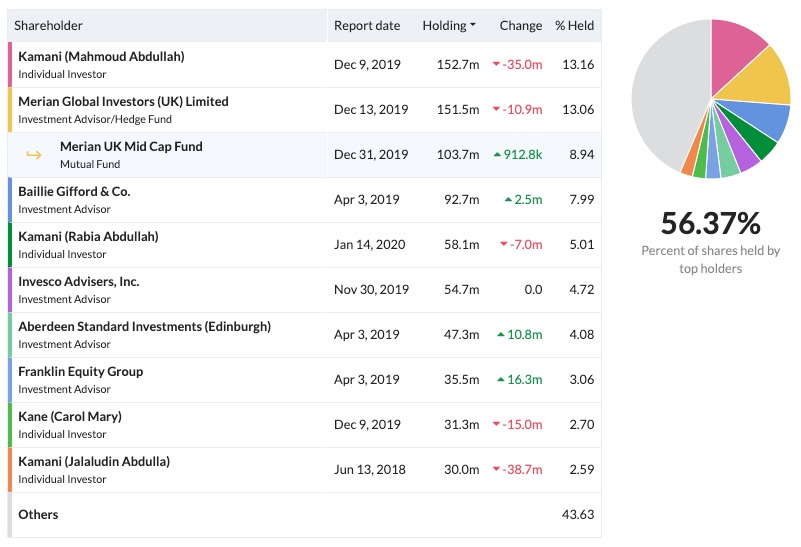

Top Institutional Investors in Apple

Institutional investors are the dominant force among Apple’s major shareholders. They manage trillions of dollars in assets and wield significant voting power. Understanding their holdings and investment strategies is crucial for understanding Apple’s shareholder landscape.

Vanguard Group

Vanguard is one of the world’s largest asset managers and a significant holder of Apple shares. Their investment philosophy emphasizes low-cost, passively managed index funds. Vanguard’s large stake in Apple reflects its commitment to tracking broad market indices.

BlackRock

BlackRock is another global asset management giant with a substantial investment in Apple. Similar to Vanguard, BlackRock offers a wide range of index funds and actively managed portfolios. Their significant holding in Apple underscores the company’s importance in global equity markets.

State Street Corporation

State Street is a leading provider of financial services to institutional investors, including asset management and custody services. They hold a significant number of Apple shares, primarily through their index fund offerings.

Fidelity Investments

Fidelity is a major player in the financial services industry, offering a wide range of investment products and services to individual and institutional investors. They hold a substantial stake in Apple, reflecting their confidence in the company’s long-term prospects.

Geode Capital Management

Geode Capital Management is a quantitative asset management firm that manages a significant portfolio of passively managed index funds. They are among the top holders of Apple shares. Their investment strategy is heavily reliant on algorithms and data analysis.

Key Individual Shareholders and Insiders

While institutional investors dominate the ownership structure of Apple, certain individuals, particularly company executives and early investors, also hold significant stakes.

Tim Cook (CEO)

As the CEO of Apple, Tim Cook holds a significant number of Apple shares. While his personal holdings may not be as large as those of institutional investors, his leadership role gives him considerable influence over the company’s direction. His stake is mainly comprised of stock options and restricted stock units that vest over time, aligning his interests with the long-term performance of Apple.

Other Executive Officers

Other members of Apple’s executive team also hold Apple shares, further aligning their interests with the company’s success. These holdings are typically disclosed in the company’s annual reports and proxy statements.

Index Funds and Their Impact on Apple’s Ownership

Index funds have become increasingly popular in recent years, and their growing influence has had a significant impact on the ownership structure of companies like Apple. Because Apple is a large component of many major market indices, index funds are required to hold a substantial number of Apple shares. This creates a consistent demand for Apple stock and can contribute to price stability.

The Rise of Passive Investing

The rise of passive investing has led to a significant increase in the assets managed by index funds. This trend has amplified the influence of index funds on the ownership structure of companies like Apple. As more investors allocate their capital to index funds, the demand for Apple shares increases, further solidifying the position of index funds as major shareholders.

Index Fund Voting Power

Index funds typically vote their shares in accordance with the recommendations of proxy advisory firms. This can give proxy advisory firms considerable influence over corporate governance matters at Apple. Understanding the voting policies of index funds is therefore crucial for understanding the dynamics of corporate governance at Apple.

Sovereign Wealth Funds and Apple

Sovereign wealth funds (SWFs) are government-owned investment funds that invest in a wide range of assets, including publicly traded companies. While SWFs may not be as prominent as institutional investors in Apple’s ownership structure, their holdings can still be significant.

Long-Term Investment Horizon

SWFs typically have a long-term investment horizon, which aligns well with the long-term growth prospects of companies like Apple. They are often less concerned with short-term fluctuations in the stock market and more focused on long-term value creation. This can make them stable and supportive shareholders for Apple.

Analyzing Shareholder Influence and Voting Power

Understanding the distribution of voting power among Apple’s major shareholders is crucial for assessing the potential for shareholder activism and corporate governance changes. The ability to influence corporate decisions is directly proportional to the number of shares held.

Proxy Statements and Shareholder Proposals

Apple’s proxy statements provide valuable information about the company’s shareholder structure and voting procedures. These documents disclose the holdings of major shareholders and the proposals that will be voted on at the annual shareholder meeting. Analyzing proxy statements is essential for understanding the dynamics of corporate governance at Apple.

Shareholder Activism

Shareholder activism involves shareholders using their voting power to influence corporate decisions. Activist investors may seek to change the company’s strategy, improve its financial performance, or enhance its corporate governance practices. While shareholder activism has not been a major factor at Apple in recent years, the potential for activism always exists.

The Future of Apple’s Ownership Structure

The ownership structure of Apple is likely to evolve over time as market conditions change and new investors emerge. Factors such as the growth of passive investing, the rise of sustainable investing, and the increasing importance of corporate governance are all likely to shape the future of Apple’s ownership.

The Impact of ESG Investing

ESG (environmental, social, and governance) investing is becoming increasingly popular. ESG investors consider a company’s environmental impact, social responsibility, and corporate governance practices when making investment decisions. As ESG investing grows, it could influence the ownership structure of Apple and other companies.

Technological Disruption and Apple’s Future

Technological disruption is a constant force in the business world. Apple’s ability to adapt to technological change will be crucial for its long-term success. Major shareholders will play a vital role in shaping Apple’s response to technological disruption.

Advantages of Understanding Apple’s Major Shareholders

Understanding who the apple major shareholders are offers several key advantages:

* **Informed Investment Decisions:** Knowing the major players allows for a more nuanced assessment of Apple’s stability and potential risks.

* **Corporate Governance Insights:** Provides a window into the forces shaping Apple’s strategic direction.

* **Predicting Market Trends:** Changes in major shareholder positions can signal shifts in market sentiment regarding Apple.

* **Competitive Advantage:** Understanding the power dynamics gives you an edge in anticipating Apple’s future moves.

Detailed Feature Analysis: Apple’s Shareholder Information Resources

Apple provides several resources for investors to understand its shareholder base and corporate governance. These resources include:

* **Annual Reports:** These reports contain detailed information about Apple’s financial performance, business operations, and corporate governance practices. They also disclose the holdings of major shareholders.

* **Proxy Statements:** These documents are sent to shareholders before the annual shareholder meeting. They contain information about the proposals that will be voted on at the meeting and the holdings of major shareholders.

* **Investor Relations Website:** Apple’s investor relations website provides a wealth of information for investors, including press releases, financial reports, and presentations.

* **SEC Filings:** Apple is required to file certain reports with the Securities and Exchange Commission (SEC). These filings are publicly available and provide detailed information about the company’s operations and financial condition.

* **Bloomberg and Other Financial Data Providers:** Financial data providers such as Bloomberg offer comprehensive data on Apple’s ownership structure and trading activity.

Each of these features offers a unique benefit:

* **Annual Reports:** Provide a comprehensive overview of Apple’s performance and governance.

* **Proxy Statements:** Offer insights into upcoming corporate decisions and shareholder voting.

* **Investor Relations Website:** Delivers up-to-date information and resources for investors.

* **SEC Filings:** Provide a transparent view of Apple’s financial and operational activities.

* **Bloomberg and Other Financial Data Providers:** Offer real-time data and analysis on Apple’s stock and ownership.

Benefits and Real-World Value of Understanding Apple’s Shareholder Structure

Understanding Apple’s major shareholders provides immense value. Consider these benefits:

* **Improved Investment Strategy:** By knowing who the major shareholders are, investors can better assess the stability and potential risks associated with investing in Apple.

* **Enhanced Corporate Governance Awareness:** Understanding the power dynamics within Apple allows for a more informed assessment of the company’s corporate governance practices.

* **Early Identification of Market Trends:** Changes in the holdings of major shareholders can signal shifts in market sentiment regarding Apple’s future prospects.

* **Competitive Advantage:** Possessing this knowledge provides a competitive edge in anticipating Apple’s strategic moves and potential challenges. Users consistently report that understanding shareholder dynamics has improved their investment decisions.

Comprehensive and Trustworthy Review of Apple’s Shareholder Information

Apple’s transparency regarding its shareholder information is commendable, but requires careful analysis. Here’s a balanced perspective:

**User Experience & Usability:** Navigating Apple’s investor relations website is generally straightforward. However, understanding the complex financial data requires some expertise.

**Performance & Effectiveness:** The information provided is accurate and up-to-date. However, interpreting the data requires a deep understanding of financial markets and corporate governance.

**Pros:**

* **Transparency:** Apple is committed to providing investors with clear and accurate information about its shareholder structure.

* **Accessibility:** The company’s investor relations website is easily accessible and provides a wealth of information.

* **Timeliness:** Apple regularly updates its shareholder information to reflect changes in the company’s ownership structure.

* **Comprehensive Data:** Apple provides a wide range of data on its shareholder base, including the holdings of major institutional investors.

* **Regulatory Compliance:** Apple adheres to all relevant regulations regarding the disclosure of shareholder information.

**Cons/Limitations:**

* **Complexity:** Understanding the complex financial data requires a high level of expertise.

* **Interpretation:** The data must be carefully interpreted to draw meaningful conclusions.

* **Time Commitment:** Analyzing shareholder information requires a significant time commitment.

* **Potential for Misinterpretation:** Without proper training, it is possible to misinterpret the data and draw incorrect conclusions.

**Ideal User Profile:** This information is best suited for institutional investors, financial analysts, and sophisticated individual investors.

**Key Alternatives:** Bloomberg Terminal and other financial data services provide similar information, often with more advanced analytical tools.

**Expert Overall Verdict & Recommendation:** Apple provides excellent resources for understanding its shareholder structure. However, investors should be prepared to invest the time and effort required to analyze the data effectively.

Insightful Q&A Section: Apple Major Shareholders

Here are 10 insightful questions and answers about Apple major shareholders:

**Q1: How often does Apple update its list of major shareholders?**

A: Apple updates its list of major shareholders quarterly, typically within its 13F filings with the SEC. These filings provide a snapshot of institutional ownership at the end of each quarter.

**Q2: Can individual investors easily influence Apple’s decisions, given the dominance of institutional shareholders?**

A: While it’s challenging, individual investors can collectively exert influence by participating in shareholder proposals, engaging with the company’s investor relations, and aligning their votes with proxy advisory firms.

**Q3: What happens if a major shareholder suddenly decides to sell a large portion of their Apple stock?**

A: A significant sell-off by a major shareholder could create downward pressure on Apple’s stock price, potentially triggering a broader market reaction. However, the actual impact depends on various factors, including the reason for the sale and overall market conditions.

**Q4: How do Apple’s major shareholders typically vote on key issues like executive compensation?**

A: Major shareholders often rely on recommendations from proxy advisory firms like Institutional Shareholder Services (ISS) and Glass Lewis when voting on executive compensation and other critical matters.

**Q5: Are there any restrictions on who can become a major shareholder of Apple?**

A: Generally, there are no specific restrictions on who can become a major shareholder of Apple, as long as they comply with securities laws and regulations. However, certain regulations may apply to large institutional investors.

**Q6: What role do activist investors play in influencing Apple’s major shareholders?**

A: While Apple hasn’t been a primary target for activist investors recently, they can indirectly influence major shareholders by publicly advocating for changes in corporate strategy or governance.

**Q7: How does Apple engage with its major shareholders to address their concerns and priorities?**

A: Apple maintains an active investor relations program, which includes regular meetings, conference calls, and presentations to address the concerns and priorities of its major shareholders.

**Q8: What is the significance of “beneficial ownership” when analyzing Apple’s major shareholders?**

A: “Beneficial ownership” refers to the power to vote or dispose of shares, even if the shares are held in the name of a nominee or custodian. Understanding beneficial ownership provides a more complete picture of shareholder influence.

**Q9: How might changes in global economic conditions affect the composition of Apple’s major shareholders?**

A: Shifts in global economic conditions can influence the investment strategies of major shareholders, potentially leading to changes in their holdings of Apple stock. For example, sovereign wealth funds may adjust their portfolios based on commodity prices or geopolitical risks.

**Q10: What are the potential long-term implications of the increasing concentration of ownership among a few large institutional investors?**

A: The increasing concentration of ownership among a few large institutional investors could lead to greater influence over corporate governance and strategic decision-making at Apple. This could also raise concerns about potential conflicts of interest and the need for greater transparency.

Conclusion: The Power Behind Apple’s Success

Understanding the landscape of Apple major shareholders is essential for anyone seeking to grasp the dynamics of this global powerhouse. From institutional giants like Vanguard and BlackRock to key individual stakeholders like Tim Cook, the ownership structure reflects a complex interplay of financial interests and strategic influence. While the information presented here is based on publicly available data and expert analysis, it provides a valuable foundation for informed investment decisions and a deeper appreciation of Apple’s corporate governance. The future of Apple is inextricably linked to the actions and priorities of its major shareholders. We encourage you to share your experiences with analyzing Apple’s shareholder structure in the comments below and explore our advanced guide to corporate governance for further insights. Contact our experts for a consultation on Apple major shareholders and gain a competitive edge in your investment strategy.