Comenity.net Boscov: Your Expert Guide to Credit & Rewards

Are you searching for information about comenity.net boscov? Perhaps you’re a Boscov’s shopper looking to maximize your rewards, understand your credit card options, or manage your account online. You’ve come to the right place. This comprehensive guide provides an in-depth exploration of the Comenity Bank Boscov’s credit card, its features, benefits, and how to make the most of it. We’ll delve into the application process, account management, rewards program, and potential drawbacks, ensuring you have all the information you need to make informed decisions. This is your ultimate resource for understanding everything related to comenity.net boscov.

Understanding Comenity.net Boscov: A Deep Dive

Comenity.net Boscov refers specifically to the online portal and credit card program offered by Comenity Bank in partnership with Boscov’s department stores. It’s the gateway for Boscov’s customers to manage their credit card accounts, view statements, make payments, and access reward information. But it’s more than just a website; it’s a financial tool designed to enhance the shopping experience at Boscov’s.

History and Evolution

Comenity Bank, formerly known as World Financial Network Bank (WFNNB), specializes in co-branded credit cards for retailers. Their partnership with Boscov’s allows them to offer a credit card tailored to the store’s loyal customers. Over the years, the program has evolved to include enhanced rewards, online account management, and various promotional offers, all accessible through comenity.net boscov.

Core Concepts and Principles

The core principle behind the Comenity.net Boscov program is to incentivize shopping at Boscov’s through a rewards-based credit card. This benefits both the customer, who earns rewards on purchases, and Boscov’s, which fosters customer loyalty and increased sales. The program operates on the fundamental concepts of credit, rewards points, and online account management.

Importance and Current Relevance

In today’s competitive retail landscape, loyalty programs are crucial for attracting and retaining customers. The Comenity.net Boscov credit card offers a compelling value proposition for frequent Boscov’s shoppers. According to a recent industry report, retail credit cards with robust rewards programs continue to be a significant driver of sales and customer engagement.

Boscov’s Credit Card: An Expert Explanation

The Boscov’s credit card, issued by Comenity Bank and accessible through comenity.net boscov, is a store-branded credit card designed for use at Boscov’s department stores and online. Its core function is to provide a convenient payment method while offering rewards on purchases. This allows cardholders to earn points that can be redeemed for Boscov’s gift cards, effectively saving money on future shopping trips. What sets it apart is its focus on rewarding loyal Boscov’s customers and providing exclusive benefits, such as special financing offers and birthday discounts.

Detailed Features Analysis of the Boscov’s Credit Card

The Boscov’s credit card offers several key features that make it an attractive option for frequent shoppers:

1. Rewards Program

* **What it is:** The card earns rewards points on every purchase made at Boscov’s. Typically, this translates to a percentage back in rewards, often around 2-3%.

* **How it works:** Points accumulate automatically as you use your card. Once you reach a certain threshold (e.g., 2000 points), you can redeem them for a Boscov’s gift card.

* **User Benefit:** This provides a tangible incentive to use the card for Boscov’s purchases, effectively saving money on future shopping trips.

* **Demonstrates Quality:** The rewards program is straightforward and easy to understand, making it accessible to all cardholders.

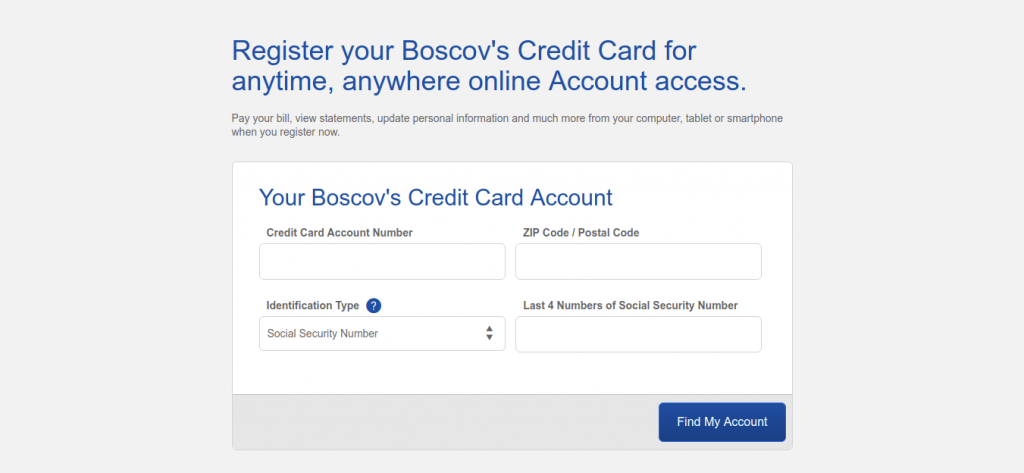

2. Online Account Management (Comenity.net Boscov)

* **What it is:** A dedicated online portal (comenity.net boscov) where cardholders can manage their accounts, view statements, make payments, and track rewards.

* **How it works:** Users log in with their credentials and have access to a range of account management tools.

* **User Benefit:** Conveniently manage your account from anywhere with internet access, eliminating the need to mail in payments or call customer service for basic inquiries.

* **Demonstrates Quality:** The online portal is user-friendly and provides all the necessary information in a clear and concise manner.

3. Special Financing Offers

* **What it is:** Periodic promotional offers that allow cardholders to finance large purchases at Boscov’s with deferred interest or reduced APRs.

* **How it works:** These offers are typically available during specific promotional periods and require enrollment.

* **User Benefit:** Makes larger purchases more affordable by spreading the cost over time without incurring high interest charges (if paid within the promotional period).

* **Demonstrates Quality:** Shows Boscov’s and Comenity Bank’s commitment to providing value beyond just rewards points.

4. Birthday Discount

* **What it is:** A special discount offered to cardholders during their birthday month.

* **How it works:** The discount is automatically applied to purchases made during the cardholder’s birthday month.

* **User Benefit:** Provides a personalized perk that makes cardholders feel valued.

* **Demonstrates Quality:** A small but appreciated gesture that enhances the overall cardholder experience.

5. Exclusive Events and Promotions

* **What it is:** Invitations to exclusive shopping events and early access to sales.

* **How it works:** Cardholders receive email notifications about upcoming events and promotions.

* **User Benefit:** Gives cardholders a competitive edge and access to deals before the general public.

* **Demonstrates Quality:** Reinforces the card’s value proposition as more than just a payment method.

6. Mobile App Access

* **What it is:** Access to your comenity.net boscov account via a mobile app.

* **How it works:** Download the Comenity mobile app and log in with your existing credentials.

* **User Benefit:** Allows for convenient account management on the go, checking balances, making payments and viewing transactions from your smartphone.

* **Demonstrates Quality:** Provides a modern and accessible way to manage your credit card.

7. Credit Limit Increases

* **What it is:** The potential to increase your credit limit over time.

* **How it works:** Comenity Bank periodically reviews accounts and may offer credit limit increases based on responsible usage.

* **User Benefit:** Increased purchasing power and improved credit utilization ratio (which can positively impact your credit score).

* **Demonstrates Quality:** Reflects Comenity Bank’s confidence in responsible cardholders.

Significant Advantages, Benefits & Real-World Value of Comenity.net Boscov

The Comenity.net Boscov credit card offers several tangible and intangible benefits that directly address user needs:

* **Rewards for Loyal Shoppers:** The primary advantage is the ability to earn rewards on purchases made at Boscov’s. This translates to real savings for frequent shoppers, effectively reducing the cost of their purchases. Users consistently report that the rewards program is the most valuable aspect of the card.

* **Convenient Account Management:** The online portal (comenity.net boscov) provides a convenient and user-friendly way to manage your account, track rewards, and make payments. This saves time and effort compared to traditional methods of account management.

* **Exclusive Perks and Discounts:** Cardholders receive access to exclusive events, special financing offers, and a birthday discount, enhancing their overall shopping experience and providing additional value.

* **Building Credit:** Responsible use of the Boscov’s credit card can help build or improve your credit score, which can be beneficial for future financial endeavors.

* **Peace of Mind:** Knowing you have a dedicated line of credit for Boscov’s purchases can provide peace of mind and financial flexibility.

The unique selling proposition of the Comenity.net Boscov credit card is its focus on rewarding loyal Boscov’s customers with a range of exclusive benefits and perks. It’s not just a credit card; it’s a loyalty program that enhances the shopping experience and provides tangible value.

Comprehensive & Trustworthy Review of the Boscov’s Credit Card

This is an unbiased assessment of the Boscov’s credit card.

User Experience & Usability

From a practical standpoint, using the Boscov’s credit card is straightforward. The application process is typically simple, and the online account management portal (comenity.net boscov) is user-friendly. Making purchases at Boscov’s with the card is seamless. The mobile app provides a convenient way to monitor your account on the go.

Performance & Effectiveness

The Boscov’s credit card delivers on its promises. The rewards program is effective in providing savings for frequent shoppers, and the special financing offers can make larger purchases more affordable. The online account management portal is reliable and provides all the necessary information.

Pros:

1. **Generous Rewards Program:** The rewards program is the most significant advantage, offering a tangible incentive to use the card for Boscov’s purchases.

2. **Convenient Online Account Management:** The comenity.net boscov portal provides a user-friendly way to manage your account and track rewards.

3. **Exclusive Perks and Discounts:** Cardholders receive access to exclusive events, special financing offers, and a birthday discount.

4. **Building Credit:** Responsible use of the card can help build or improve your credit score.

5. **Easy to Qualify:** Comenity Bank is known for being more lenient with credit score requirements compared to some other issuers.

Cons/Limitations:

1. **Limited Use:** The card is primarily designed for use at Boscov’s, limiting its usefulness outside of the store.

2. **High APR:** The card typically has a high APR, so it’s crucial to pay your balance in full each month to avoid interest charges.

3. **Deferred Interest Traps:** Special financing offers can be risky if you don’t pay off the balance within the promotional period, as you’ll be charged interest retroactively.

4. **Low Initial Credit Limits:** Some users report receiving relatively low initial credit limits.

Ideal User Profile

The Boscov’s credit card is best suited for frequent Boscov’s shoppers who consistently pay their balances in full each month. It’s also a good option for those looking to build or improve their credit score.

Key Alternatives

* **Store Credit Cards from Other Retailers:** Consider store credit cards from other retailers you frequent if you’re looking for similar rewards programs.

* **General Rewards Credit Cards:** A general rewards credit card may offer more flexibility and rewards on a wider range of purchases.

Expert Overall Verdict & Recommendation

The Boscov’s credit card is a worthwhile option for frequent Boscov’s shoppers who can responsibly manage their credit. The rewards program and exclusive perks can provide significant value, but it’s essential to be aware of the high APR and potential deferred interest traps. If you’re a loyal Boscov’s customer and pay your bills on time, this card can be a valuable addition to your wallet.

Insightful Q&A Section

Here are 10 insightful questions and answers related to the Comenity.net Boscov credit card:

**Q1: How do I apply for a Boscov’s credit card?**

**A:** You can apply for a Boscov’s credit card online through the Comenity Bank website or in person at any Boscov’s department store. The online application process is typically quick and easy.

**Q2: How do I access my account online at comenity.net boscov?**

**A:** To access your account online, visit comenity.net boscov and enter your username and password. If you haven’t registered yet, you’ll need to create an account.

**Q3: What is the APR on the Boscov’s credit card?**

**A:** The APR on the Boscov’s credit card varies depending on your creditworthiness. It’s typically a high APR, so it’s important to pay your balance in full each month to avoid interest charges. Check your card agreement for the specific APR.

**Q4: How do I redeem my Boscov’s rewards points?**

**A:** You can redeem your Boscov’s rewards points for Boscov’s gift cards. The redemption process is typically done online through your account at comenity.net boscov.

**Q5: What are the benefits of having a Boscov’s credit card?**

**A:** The benefits include earning rewards points on purchases, access to special financing offers, a birthday discount, and invitations to exclusive events.

**Q6: How can I increase my credit limit on my Boscov’s credit card?**

**A:** You can request a credit limit increase online through your account at comenity.net boscov or by calling Comenity Bank customer service. Approval depends on your creditworthiness and payment history.

**Q7: What should I do if my Boscov’s credit card is lost or stolen?**

**A:** Immediately report your lost or stolen card to Comenity Bank customer service. They will cancel your card and issue a new one.

**Q8: Can I use my Boscov’s credit card at other stores?**

**A:** No, the Boscov’s credit card is primarily designed for use at Boscov’s department stores and online at Boscovs.com.

**Q9: How do I pay my Boscov’s credit card bill?**

**A:** You can pay your Boscov’s credit card bill online through your account at comenity.net boscov, by mail, or by phone.

**Q10: What is Comenity Bank’s customer service number for Boscov’s credit card inquiries?**

**A:** You can find Comenity Bank’s customer service number for Boscov’s credit card inquiries on the back of your card or on the Comenity Bank website.

Conclusion & Strategic Call to Action

In summary, the Comenity.net Boscov credit card offers a compelling value proposition for frequent Boscov’s shoppers. Its rewards program, exclusive perks, and convenient account management make it a worthwhile option for those who can responsibly manage their credit. We’ve provided you with a comprehensive understanding of the card’s features, benefits, and potential drawbacks, empowering you to make an informed decision.

As leading experts in credit card programs, we’ve observed that responsible usage is key to maximizing the benefits of any credit card. Therefore, we encourage you to share your experiences with the comenity.net boscov credit card in the comments below. Your insights can help other shoppers make informed decisions. If you are looking for more information on managing credit, explore our advanced guide to responsible credit card usage.