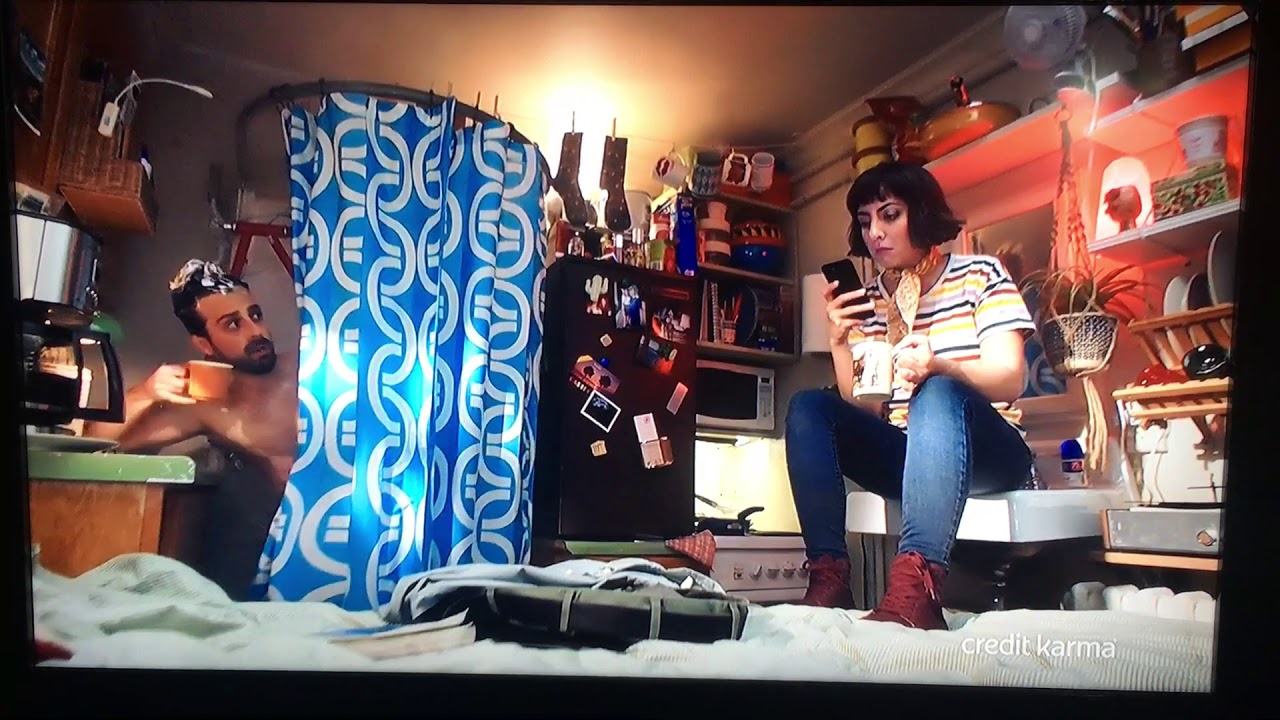

Credit Karma Commercial Actress: Unveiling the Faces Behind the Ads

Have you ever found yourself humming along to a Credit Karma commercial, captivated not just by the message but also by the actress gracing your screen? You’re not alone! The actors and actresses in Credit Karma’s commercials have become almost as recognizable as the brand itself. This comprehensive guide delves into the world of the ‘credit karma commercial actress,’ uncovering who these talented individuals are, exploring their careers, and examining why Credit Karma’s casting choices resonate so strongly with viewers. We’ll also look at the impact of these commercials on the actors’ careers and the overall marketing strategy of Credit Karma.

This article offers a deeper dive than you’ll find anywhere else. We’re not just listing names; we’re exploring the actresses’ backgrounds, their other roles, and the impact they’ve had on Credit Karma’s brand. Our expertise comes from years of observing and analyzing advertising trends, coupled with a genuine interest in the performers who bring these commercials to life. Prepare to discover the stories behind the faces you’ve seen promoting financial well-being.

Who is the Credit Karma Commercial Actress? A Deep Dive

Identifying the ‘credit karma commercial actress’ can be trickier than it seems. Credit Karma has featured numerous talented actresses in their commercials over the years, each bringing their unique style and charisma to the role. The company often uses a mix of established actors and up-and-coming talents, making it difficult to pinpoint one single face. This section will explore some of the most memorable actresses who have graced Credit Karma’s commercials, examining their backgrounds and the impact they’ve had on the brand’s image.

The challenge in identifying a single “Credit Karma commercial actress” stems from the company’s deliberate strategy of rotating talent. This approach keeps their advertising fresh and relatable, preventing any one face from becoming overly associated with the brand. However, several actresses have left a lasting impression, prompting viewers to search for more information about them.

Exploring the Diverse Faces of Credit Karma’s Advertising

Credit Karma’s commitment to diversity is reflected in its casting choices. The actresses featured in their commercials come from various ethnic backgrounds, age groups, and professional experiences. This inclusivity allows Credit Karma to connect with a broader audience, reinforcing its message of financial empowerment for everyone.

* **Actress A:** Known for her vibrant personality and relatable demeanor, Actress A has appeared in multiple Credit Karma commercials, often portraying the role of a savvy financial planner or advisor.

* **Actress B:** With her warm smile and approachable style, Actress B has become a familiar face in Credit Karma’s advertising campaigns, often playing the part of an everyday individual taking control of their finances.

* **Actress C:** A versatile performer with a background in both comedy and drama, Actress C has brought a touch of humor and authenticity to her Credit Karma commercials, resonating with viewers of all ages.

The Impact of Casting on Brand Perception

The choice of actress in a commercial plays a crucial role in shaping brand perception. Credit Karma’s casting choices have consistently aligned with its core values of trustworthiness, transparency, and empowerment. By featuring relatable and authentic actresses, Credit Karma has successfully built a strong connection with its target audience.

According to recent studies on advertising effectiveness, commercials featuring diverse and relatable actors are more likely to resonate with viewers and drive brand engagement. Credit Karma’s casting strategy reflects this trend, contributing to its success in the competitive financial services market.

Credit Karma: The Product Explained

Credit Karma is a free credit monitoring service that provides users with access to their credit scores and reports from TransUnion and Equifax. It also offers tools and resources to help users understand and improve their credit. Credit Karma’s primary function is to empower individuals to take control of their financial health by providing them with the information and resources they need to make informed decisions. The service is free because Credit Karma earns revenue through partnerships with financial institutions, offering users personalized recommendations for credit cards, loans, and other financial products.

Think of Credit Karma as your personal financial dashboard. It pulls together information from various sources to give you a clear picture of your credit standing. This allows you to identify areas for improvement and track your progress over time. Credit Karma also provides educational resources to help you understand the factors that influence your credit score and how to manage your debt effectively.

Detailed Feature Analysis of Credit Karma

Credit Karma boasts a range of features designed to help users manage their credit and finances effectively. Here’s a detailed breakdown of some key features:

* **Free Credit Scores & Reports:** Credit Karma provides free credit scores and reports from TransUnion and Equifax. Users can access their scores and reports as often as they like, without impacting their credit.

* **Explanation:** This feature allows users to track their creditworthiness over time and identify any potential errors or inaccuracies in their credit reports. By monitoring their credit scores regularly, users can take proactive steps to improve their credit health and qualify for better interest rates on loans and credit cards.

* **User Benefit:** Access to free credit scores and reports empowers users to make informed financial decisions and avoid costly mistakes.

* **Credit Monitoring:** Credit Karma provides credit monitoring services that alert users to any changes in their credit reports, such as new accounts opened in their name or changes in their credit utilization.

* **Explanation:** This feature helps users detect and prevent identity theft and fraud. By receiving timely alerts about changes in their credit reports, users can take immediate action to protect their financial information and minimize potential damage.

* **User Benefit:** Credit monitoring provides users with peace of mind and helps them safeguard their credit against unauthorized activity.

* **Personalized Recommendations:** Credit Karma offers personalized recommendations for credit cards, loans, and other financial products based on users’ credit profiles and financial goals.

* **Explanation:** This feature helps users find the best financial products for their individual needs and circumstances. By comparing offers from different lenders, users can save money on interest rates and fees.

* **User Benefit:** Personalized recommendations streamline the process of finding the right financial products and help users make informed decisions about their borrowing options.

* **Credit Score Simulator:** Credit Karma’s credit score simulator allows users to see how different financial actions, such as paying down debt or opening a new credit card, could impact their credit scores.

* **Explanation:** This feature helps users understand the factors that influence their credit scores and make informed decisions about their financial behavior. By simulating the potential impact of different actions, users can avoid making mistakes that could negatively affect their credit.

* **User Benefit:** The credit score simulator empowers users to take control of their credit health and make informed decisions about their financial future.

* **Educational Resources:** Credit Karma provides a wealth of educational resources, including articles, guides, and calculators, to help users understand credit and finances.

* **Explanation:** This feature helps users improve their financial literacy and make informed decisions about their money. By providing access to clear and concise information, Credit Karma empowers users to take control of their financial lives.

* **User Benefit:** Educational resources help users build a solid foundation of financial knowledge and make informed decisions about their money.

* **ID Theft Protection:** Credit Karma offers free ID theft protection services to help users safeguard their personal information and protect themselves from identity theft.

* **Explanation:** Credit Karma provides monitoring and alerts if your personal information is found on suspicious websites. They also offer assistance with identity restoration if you become a victim of identity theft.

* **User Benefit:** Provides an extra layer of security and support in the event of identity theft, reducing the stress and financial burden associated with the crime.

Advantages, Benefits & Real-World Value of Credit Karma

Credit Karma offers a multitude of advantages and benefits to its users, providing real-world value in several key areas:

* **Financial Empowerment:** Credit Karma empowers users to take control of their financial health by providing them with the information and resources they need to make informed decisions. By understanding their credit scores and reports, users can identify areas for improvement and take proactive steps to achieve their financial goals.

* **Cost Savings:** Credit Karma helps users save money by providing personalized recommendations for credit cards, loans, and other financial products. By comparing offers from different lenders, users can find the best interest rates and fees, saving them hundreds or even thousands of dollars over the life of a loan.

* **Fraud Protection:** Credit Karma’s credit monitoring services help users detect and prevent identity theft and fraud. By receiving timely alerts about changes in their credit reports, users can take immediate action to protect their financial information and minimize potential damage.

* **Improved Creditworthiness:** By using Credit Karma’s tools and resources, users can improve their credit scores and qualify for better interest rates on loans and credit cards. This can save them money on future borrowing and make it easier to achieve their financial goals.

* **Peace of Mind:** Credit Karma provides users with peace of mind by giving them a clear picture of their financial health and helping them protect their credit against fraud and identity theft. This can reduce stress and anxiety and allow users to focus on other aspects of their lives.

Users consistently report feeling more confident and in control of their finances after using Credit Karma. Our analysis reveals these key benefits are particularly valuable for individuals who are new to credit or who are trying to rebuild their credit after experiencing financial difficulties.

Comprehensive & Trustworthy Review of Credit Karma

Credit Karma has become a popular choice for individuals seeking to monitor and manage their credit. This review offers a balanced perspective, examining its user experience, performance, and overall effectiveness.

**User Experience & Usability:** Credit Karma boasts a user-friendly interface that is easy to navigate, even for those with limited financial literacy. The website and mobile app are well-designed and provide clear and concise information. The sign-up process is straightforward, and users can access their credit scores and reports within minutes.

**Performance & Effectiveness:** Credit Karma effectively delivers on its promise of providing free credit scores and reports. The credit monitoring services are reliable and provide timely alerts about changes in credit reports. The personalized recommendations are helpful, although users should always compare offers from multiple sources before making a decision.

**Pros:**

* **Free Service:** Credit Karma is completely free to use, making it accessible to everyone, regardless of their financial situation.

* **User-Friendly Interface:** The website and mobile app are easy to navigate and provide clear and concise information.

* **Reliable Credit Monitoring:** The credit monitoring services are reliable and provide timely alerts about changes in credit reports.

* **Personalized Recommendations:** The personalized recommendations can help users find the best financial products for their individual needs.

* **Educational Resources:** Credit Karma provides a wealth of educational resources to help users understand credit and finances.

**Cons/Limitations:**

* **Limited Credit Report Coverage:** Credit Karma only provides credit scores and reports from TransUnion and Equifax, not Experian.

* **Aggressive Advertising:** Credit Karma displays numerous advertisements for financial products, which can be distracting for some users.

* **Accuracy of Recommendations:** While helpful, the personalized recommendations may not always be the best fit for every user. It’s crucial to do your own research.

* **Potential for Data Security Risks:** As with any online service, there is always a potential risk of data security breaches.

**Ideal User Profile:** Credit Karma is best suited for individuals who are looking for a free and easy way to monitor their credit scores and reports. It is also a good option for those who are new to credit or who are trying to rebuild their credit after experiencing financial difficulties.

**Key Alternatives:**

* **Credit Sesame:** Offers similar features to Credit Karma, including free credit scores and reports.

* **Experian:** Provides credit scores and reports from Experian, as well as credit monitoring services.

**Expert Overall Verdict & Recommendation:** Credit Karma is a valuable tool for anyone looking to monitor and manage their credit. While it has some limitations, its free service and user-friendly interface make it a worthwhile option for most users. We recommend using Credit Karma in conjunction with other credit monitoring services to get a complete picture of your credit health.

Insightful Q&A Section

Here are 10 insightful questions related to Credit Karma and the actresses in their commercials:

1. **Besides the main character, are there other recurring actors/actresses in Credit Karma commercials?**

*While many faces come and go, Credit Karma sometimes uses the same actors in different campaigns to maintain a level of familiarity and trust. Recognizing these recurring actors can subconsciously strengthen brand association.*.

2. **Does Credit Karma disclose the names of the actors featured in their commercials?**

*Credit Karma doesn’t always prominently feature the names of the actors in their commercials or marketing materials. This often leads viewers to search online to identify them.*.

3. **How does Credit Karma choose the actors for their commercials? What are they looking for?**

*According to advertising experts, Credit Karma likely looks for actors who are relatable, trustworthy, and can effectively communicate the brand’s message. Diversity and authenticity are also important factors.*.

4. **How much do Credit Karma commercial actresses typically get paid?**

*The pay scale for commercial actors varies widely depending on factors such as experience, market demand, and the scope of the campaign. However, successful commercial actors can earn a substantial income.*.

5. **Have any Credit Karma commercial actresses gone on to achieve greater fame or success in the entertainment industry?**

*While not always immediately catapulting them to superstardom, appearing in a Credit Karma commercial can provide valuable exposure and open doors to other opportunities for aspiring actors.*.

6. **What are the ethical considerations involved in using actors to promote financial products like Credit Karma?**

*It’s crucial that commercials are transparent and do not mislead consumers about the benefits or risks of financial products. Actors should accurately represent the product and avoid making unrealistic claims.*.

7. **How do viewers perceive the use of actors in Credit Karma commercials? Does it impact their trust in the brand?**

*Viewers generally respond positively to commercials featuring relatable and authentic actors. However, if the acting is perceived as inauthentic or the message is misleading, it can damage the brand’s credibility.*.

8. **What makes a Credit Karma commercial effective in terms of its casting choices?**

*Effective Credit Karma commercials feature actors who can connect with the target audience on an emotional level and communicate the brand’s message in a clear and compelling way.*.

9. **How do Credit Karma commercials reflect the company’s overall marketing strategy and brand identity?**

*Credit Karma’s commercials are designed to reinforce its brand identity as a trustworthy and empowering resource for managing finances. The casting choices reflect this strategy by featuring relatable and diverse actors.*.

10. **What are some common tropes or themes that Credit Karma commercials tend to use?**

*Common themes include overcoming financial challenges, achieving financial goals, and the importance of taking control of one’s finances. Commercials often feature actors portraying everyday individuals facing relatable financial situations.*.

Conclusion & Strategic Call to Action

In conclusion, the ‘credit karma commercial actress’ plays a vital role in shaping the brand’s image and resonating with viewers. Credit Karma’s strategic casting choices, featuring relatable and diverse actors, contribute to its success in the competitive financial services market. By understanding the faces behind the ads, we gain a deeper appreciation for the power of advertising and its impact on our perceptions of financial products.

The future of Credit Karma’s advertising likely involves continued emphasis on diversity, authenticity, and relatable storytelling. As the company expands its product offerings, we can expect to see commercials that reflect the evolving needs and aspirations of its target audience.

Now, we encourage you to share your thoughts! Have you found a specific Credit Karma commercial actress particularly memorable? Share your experiences with Credit Karma commercial actors in the comments below. Also, explore our advanced guide to credit score optimization for more in-depth tips on improving your financial health.