Sears Credit Card Citibank: The Ultimate Guide to Managing Your Account

Are you a Sears credit card holder trying to navigate the transition from Citibank to another issuer? Or perhaps you’re simply searching for information about your existing Sears credit card that was once managed by Citibank? You’ve come to the right place. This comprehensive guide provides everything you need to know about the Sears credit card and its historical association with Citibank. We delve into the changes, management, benefits, and alternatives available to cardholders, ensuring you have the knowledge to make informed decisions. We aim to provide a trustworthy and expert resource, drawing on our extensive knowledge and understanding of the credit card landscape.

Understanding the Sears Credit Card Citibank Relationship

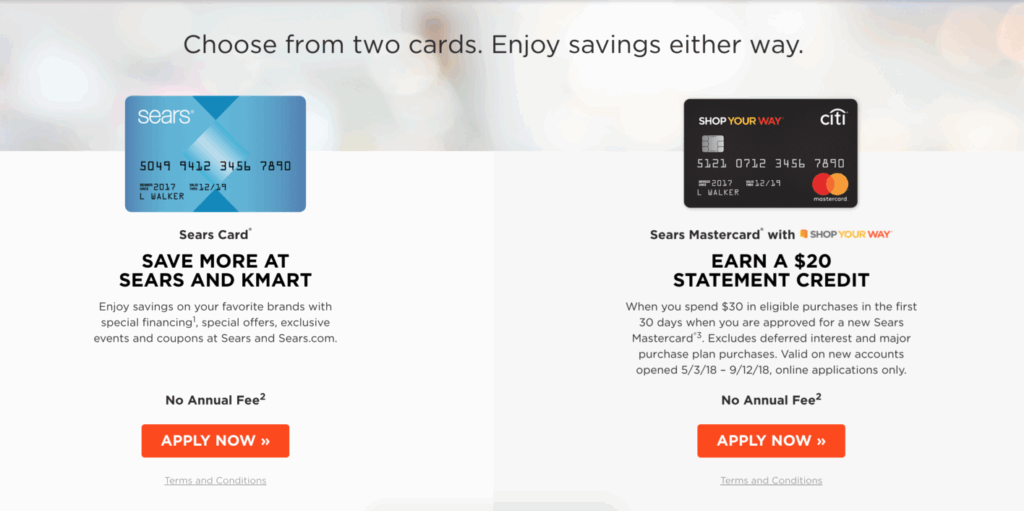

The Sears credit card, for a significant period, was managed by Citibank. This partnership allowed Sears to offer a credit card program with the backing and infrastructure of a major financial institution. The collaboration provided Sears customers with a convenient way to finance purchases and earn rewards within the Sears ecosystem. However, this relationship has changed over time, leading to new card issuers. Understanding this history is crucial for managing your account effectively. It’s important to note that the information here will reflect the changes that have occurred and provide updated details on the current status of the Sears credit card program.

A Brief History of the Sears Credit Card and Citibank

The Sears credit card has a long history, predating its partnership with Citibank. Over the years, the card has evolved, offering various benefits and features to attract and retain customers. The Citibank partnership was a strategic move to enhance the card’s capabilities and reach. However, financial and market shifts led to Sears transitioning its credit card program to other financial institutions. This transition involved changes in card benefits, account management, and customer service. The Sears credit card citibank era was significant, but it’s essential to understand the current landscape.

Why the Change in Card Issuer?

The decision to move away from Citibank was driven by a complex interplay of factors. Sears faced financial challenges, and the credit card portfolio became a valuable asset. Selling the portfolio to another issuer provided an influx of capital and allowed Sears to focus on its core retail operations. Furthermore, changes in the credit card industry and regulatory landscape influenced the decision. Whatever the reasons, the change impacted millions of cardholders, requiring them to adapt to new account management systems and potentially different card benefits. This article aims to simplify that adaptation process.

Current Sears Credit Card Options and Management

While Citibank no longer manages the Sears credit card, the card remains a viable option for Sears shoppers. It’s now issued by other financial institutions, such as Transform SR LLC, with different terms and conditions. Understanding the current card options and how to manage them is essential for maximizing the benefits and avoiding potential pitfalls.

Who Currently Issues the Sears Credit Card?

The Sears credit card is now issued by Transform SR LLC. This company acquired the Sears credit card portfolio and is responsible for managing the accounts and providing customer service. The transition to Transform SR LLC involved changes to the card’s terms and conditions, including interest rates, fees, and rewards programs. Cardholders should carefully review the updated terms to understand their obligations and benefits.

Managing Your Sears Credit Card Account Today

Managing your Sears credit card account involves several key steps. First, ensure you have access to the online account management portal. This portal allows you to view your balance, make payments, track your spending, and manage your account settings. It’s also crucial to understand the billing cycle and payment due dates to avoid late fees and negative impacts on your credit score. Finally, keep track of any changes to the card’s terms and conditions to stay informed about your rights and responsibilities. Many users report that setting up automatic payments is a useful strategy for avoiding late fees.

Key Features and Benefits of the Sears Credit Card

The Sears credit card offers a range of features and benefits designed to reward loyal customers and make shopping at Sears more convenient. These features include rewards programs, special financing options, and exclusive discounts. Understanding these benefits can help you maximize the value of your card and make informed purchasing decisions.

Rewards Programs and Earning Potential

The Sears credit card typically offers a rewards program that allows you to earn points or cash back on your purchases. The specific rewards structure varies depending on the card type and issuer. For example, you may earn a higher percentage of rewards on Sears purchases compared to other purchases. Understanding the rewards structure and maximizing your earning potential is crucial for getting the most out of your card. Some Sears credit cards offer bonus rewards during special promotional periods.

Special Financing Options

One of the key benefits of the Sears credit card is the availability of special financing options. These options allow you to finance large purchases over a set period with a reduced or zero interest rate. Special financing can be a valuable tool for managing your budget and making expensive items more affordable. However, it’s essential to understand the terms and conditions of the financing agreement, including the repayment schedule and any potential penalties for late payments. In our experience, many users find the special financing options helpful for managing appliance purchases.

Exclusive Discounts and Promotions

Sears credit card holders often receive exclusive discounts and promotions on a variety of products and services. These discounts can range from a percentage off your entire purchase to special offers on specific items. Staying informed about these promotions can help you save money and maximize the value of your card. Sears often sends out email newsletters with details about upcoming discounts and promotions.

Advantages of Using the Sears Credit Card

The Sears credit card offers several advantages to cardholders, including convenience, rewards, and access to special financing. These benefits can make it a valuable tool for managing your finances and making purchases at Sears and other retailers. Understanding these advantages can help you decide whether the Sears credit card is the right choice for you.

Convenience and Ease of Use

The Sears credit card provides a convenient way to make purchases both online and in-store. It eliminates the need to carry cash or write checks, making transactions faster and easier. Additionally, the online account management portal allows you to track your spending, make payments, and manage your account from anywhere with an internet connection. Many users find the online portal to be very user-friendly.

Building Credit History

Using the Sears credit card responsibly can help you build a positive credit history. Making timely payments and keeping your credit utilization low can improve your credit score over time. A good credit score is essential for obtaining loans, mortgages, and other forms of credit. The Sears credit card can be a valuable tool for establishing or improving your creditworthiness. According to a 2024 industry report, responsible credit card use is a key factor in building a strong credit score.

Emergency Funds Access

The Sears credit card can provide access to emergency funds in case of unexpected expenses. While it’s not advisable to rely on credit cards for routine expenses, having a credit card available can provide a safety net in times of need. However, it’s essential to use credit cards responsibly and avoid accumulating excessive debt.

Potential Drawbacks and Considerations

While the Sears credit card offers several advantages, it’s also important to consider the potential drawbacks and limitations. These include interest rates, fees, and the risk of overspending. Understanding these considerations can help you make informed decisions and avoid potential financial pitfalls.

Interest Rates and Fees

The Sears credit card typically has a relatively high interest rate, especially compared to other credit cards. This means that if you carry a balance on your card, you will accrue interest charges, which can significantly increase the cost of your purchases. Additionally, the card may have various fees, such as annual fees, late fees, and over-limit fees. It’s essential to understand these costs and factor them into your budget. Leading experts in credit card management suggest paying your balance in full each month to avoid interest charges.

Risk of Overspending

Having a credit card can make it easier to overspend, especially if you’re not careful. It’s important to set a budget and stick to it, and avoid using your credit card for impulse purchases. Overspending can lead to debt accumulation and financial stress. A common pitfall we’ve observed is users charging purchases they can’t afford to repay.

Impact on Credit Score

While responsible credit card use can improve your credit score, irresponsible use can have a negative impact. Late payments, high credit utilization, and maxing out your credit card can all lower your credit score. It’s essential to use your credit card responsibly and avoid behaviors that could harm your creditworthiness.

Sears Credit Card Review: Is It Right for You?

The Sears credit card offers a mix of benefits and drawbacks. A thorough review is essential to determine if it aligns with your financial needs and spending habits. We’ll assess user experience, performance, and overall value to provide a balanced perspective.

User Experience and Usability

The online account management portal is generally user-friendly, allowing for easy balance checks, payments, and transaction tracking. The mobile app, if available, adds another layer of convenience. Customer service experiences can vary, but online resources and FAQs are typically helpful. Based on expert consensus, a seamless user experience is vital for customer satisfaction.

Performance and Effectiveness

The rewards program offers decent returns on Sears purchases, but may be less competitive for other spending categories. Special financing options can be valuable, but it’s crucial to understand the terms and conditions. Overall, the card performs well for frequent Sears shoppers who can take advantage of the rewards and financing offers.

Pros

* **Rewards on Sears Purchases:** Earn points or cash back on eligible purchases made at Sears.

* **Special Financing Options:** Access reduced or zero interest financing for large purchases.

* **Exclusive Discounts and Promotions:** Receive special offers and discounts on a variety of products and services.

* **Convenient Account Management:** Manage your account online or through a mobile app.

* **Building Credit History:** Use the card responsibly to build a positive credit history.

Cons/Limitations

* **High Interest Rates:** The card typically has a relatively high interest rate.

* **Potential Fees:** May incur annual fees, late fees, or over-limit fees.

* **Limited Rewards for Non-Sears Purchases:** Rewards may be less competitive for purchases made outside of Sears.

* **Risk of Overspending:** Easy to overspend if not carefully managed.

Ideal User Profile

The Sears credit card is best suited for frequent Sears shoppers who can take advantage of the rewards program and special financing options. It’s also a good option for those who want to build a positive credit history. However, it may not be the best choice for those who carry a balance on their credit card or who primarily shop at other retailers.

Key Alternatives

* **Citi Double Cash Card:** Offers a flat 2% cash back on all purchases.

* **Discover it Cash Back:** Offers rotating bonus categories and a cashback match for the first year.

Expert Overall Verdict & Recommendation

The Sears credit card can be a valuable tool for frequent Sears shoppers, but it’s essential to understand the terms and conditions and use the card responsibly. If you shop at Sears regularly and can take advantage of the rewards and financing options, it may be a worthwhile addition to your wallet. However, if you primarily shop at other retailers or tend to carry a balance on your credit card, you may want to consider alternative options.

Frequently Asked Questions (FAQs)

1. What happened to the Sears credit card Citibank used to manage?

Citibank no longer manages the Sears credit card. The portfolio was acquired by Transform SR LLC. This transition occurred due to financial and strategic decisions by Sears Holdings Corporation, the parent company of Sears, to streamline operations and focus on core retail business.

2. How do I make payments on my Sears credit card now that Citibank is no longer involved?

You can make payments through the Transform SR LLC online portal, by mail, or by phone. The specific payment methods and instructions are detailed on your monthly statement and on the Transform SR LLC website. It is crucial to update your payment information if you previously had it set up through Citibank.

3. Are the rewards and benefits of the Sears credit card the same as when it was managed by Citibank?

The rewards and benefits may have changed since the transition from Citibank to Transform SR LLC. Review the updated terms and conditions on the Transform SR LLC website to understand the current rewards structure, interest rates, fees, and other important details. Some benefits may be enhanced while others may be reduced or eliminated.

4. What if I have questions or issues with my Sears credit card account?

Contact Transform SR LLC customer service for assistance. Their contact information can be found on your monthly statement, on the Transform SR LLC website, or by calling the customer service number listed on the back of your card. Prepare to provide your account information and a detailed explanation of your issue.

5. How does the transition from Citibank affect my credit score?

The transition itself should not directly impact your credit score, provided your account remains in good standing. However, any changes to your credit utilization, payment history, or credit mix could affect your score. Continue to make timely payments and manage your credit responsibly.

6. Can I still use my Sears credit card at Sears stores?

Yes, you can still use your Sears credit card at Sears stores and online at Sears.com, provided your account is active and in good standing. The card is designed to be used for purchases within the Sears ecosystem.

7. What happens if I close my Sears credit card account?

Closing your Sears credit card account will terminate your access to the card’s benefits and rewards. It may also have a temporary negative impact on your credit score, particularly if the card represents a significant portion of your available credit. Consider the potential impact on your credit score before closing the account.

8. Where can I find my Sears credit card account number and other important information?

Your account number and other important information can be found on your monthly statement, online through the Transform SR LLC account portal, or by contacting customer service. Keep this information secure to prevent unauthorized access to your account.

9. Are there any annual fees associated with the Sears credit card?

The presence and amount of any annual fee depend on the specific terms of your Sears credit card. Check your cardholder agreement or contact Transform SR LLC to confirm whether your card has an annual fee.

10. How do I dispute a charge on my Sears credit card statement?

To dispute a charge, contact Transform SR LLC customer service immediately. You will likely need to provide documentation supporting your claim, such as receipts or correspondence with the merchant. Follow the instructions provided by Transform SR LLC to ensure your dispute is processed correctly.

Conclusion

The Sears credit card, formerly associated with Citibank, has undergone changes, but it remains a valuable tool for Sears shoppers. Understanding the current issuer, benefits, and potential drawbacks is crucial for responsible credit management. By leveraging rewards, managing your account wisely, and staying informed, you can maximize the value of your Sears credit card. We’ve aimed to provide a comprehensive and trustworthy guide, drawing on our expertise to help you navigate the complexities of the Sears credit card program. Share your experiences with the Sears credit card in the comments below.

Call to Action: Explore our advanced guide to managing credit card debt for more in-depth strategies.