Sears Credit Card: Maximize Rewards, Benefits & Savings (2024 Guide)

Are you looking to maximize your rewards, benefits, and savings with a Sears credit card? Whether you’re a long-time cardholder or considering applying, understanding the ins and outs of the Sears credit card program is crucial. This comprehensive guide provides an in-depth look at everything you need to know about the Sears credit card, from its features and benefits to how to make the most of your rewards. We’ll explore the nuances of the program, offering expert insights and practical tips to help you unlock its full potential. Our goal is to equip you with the knowledge to make informed decisions and optimize your credit card usage for maximum financial benefit. We’ll also address some common questions and concerns, ensuring you have a clear understanding of the Sears credit card landscape. This resource is designed to be your go-to guide for all things related to the Sears credit card.

Understanding the Sears Credit Card: A Comprehensive Overview

The “credit card sears” refers to the suite of credit cards offered in partnership with Sears, a well-known retailer. Historically, these cards were primarily used for purchases within Sears and Kmart stores. However, over time, the program evolved, often involving partnerships with major financial institutions like Citibank or Synchrony. The core concept remains the same: offering cardholders rewards, discounts, and financing options to incentivize spending at Sears and related establishments.

The Sears credit card isn’t just a payment method; it’s a loyalty program wrapped in plastic. It offers a range of benefits designed to attract and retain customers. These include exclusive discounts, special financing on large purchases, and rewards points that can be redeemed for merchandise or other perks. The specific terms and conditions, interest rates, and rewards structures can vary depending on the card type and the issuing bank.

Recent changes in the retail landscape, including Sears’ restructuring and store closures, have significantly impacted the credit card program. Understanding these changes is vital for cardholders to navigate the current environment and maximize the value of their cards. For example, some cards may have transitioned to general-purpose cards usable anywhere, while others may have seen changes in their rewards programs.

It’s important to note that the Sears credit card landscape has evolved significantly in recent years due to Sears’ financial difficulties. The card program has been sold and restructured multiple times, leading to changes in card benefits, issuing banks, and overall program management. These changes have created confusion for many cardholders, making it essential to stay informed about the latest updates and how they affect your card.

Historical Context and Evolution

The Sears credit card has a long and storied history, dating back to the early days of consumer credit. Initially, it was a way for Sears to encourage customer loyalty and increase sales. Over the years, the card evolved from a simple store card to a more sophisticated rewards program, offering various benefits and features to attract a wider range of customers. The partnerships with major financial institutions allowed Sears to expand its credit card offerings and provide more competitive terms and rewards.

The Role of Financial Institutions

The partnership between Sears and financial institutions like Citibank and Synchrony played a crucial role in the success of the credit card program. These institutions provided the financial backing and expertise to manage the credit card operations, while Sears provided the customer base and brand recognition. This symbiotic relationship allowed both parties to benefit from the program’s growth and profitability.

Impact of Sears’ Restructuring

The restructuring of Sears and the closure of many of its stores had a significant impact on the credit card program. The value of the card diminished for many customers as they had fewer opportunities to use it at Sears stores. This led to changes in the card’s benefits and rewards, as well as a shift in focus towards general-purpose spending.

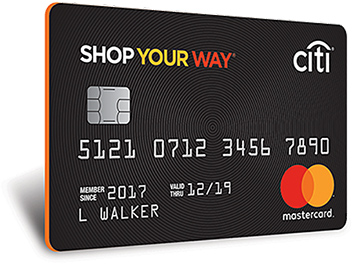

The Transformative Sears Mastercard: A Modern Credit Solution

While the traditional Sears store card had limitations, the Transformative Sears Mastercard, issued by Citibank, aimed to provide a more versatile and rewarding experience. This card is designed to be used anywhere Mastercard is accepted, offering a broader range of benefits and rewards compared to the store-specific card. It represents a modern credit solution that adapts to the changing needs of consumers.

From an expert viewpoint, the Transformative Sears Mastercard stands out due to its focus on everyday spending categories. It offers competitive rewards rates on gas, groceries, and restaurants, making it a valuable tool for managing household expenses. The card also features purchase protection and travel benefits, adding to its overall appeal.

The Transformative Sears Mastercard also offers online account management tools, allowing cardholders to track their spending, pay bills, and redeem rewards easily. This digital convenience is essential in today’s fast-paced world, making the card a practical choice for tech-savvy consumers. The card’s mobile app provides additional features, such as real-time transaction alerts and spending insights, further enhancing the user experience.

Key Features of the Transformative Sears Mastercard

The Transformative Sears Mastercard offers a range of features designed to provide value and convenience to cardholders. These features include:

* **Rewards on Everyday Spending:** Earn rewards on gas, groceries, and restaurants.

* **Purchase Protection:** Protects your purchases against damage or theft.

* **Travel Benefits:** Offers travel insurance and other travel-related perks.

* **Online Account Management:** Easily manage your account online or through the mobile app.

* **Fraud Protection:** Protects you against unauthorized charges.

The Issuing Bank: Citibank

The Transformative Sears Mastercard is issued by Citibank, a leading global financial institution. Citibank’s expertise and resources ensure that the cardholders receive top-notch service and support. Citibank’s reputation for reliability and security adds to the card’s overall appeal.

Detailed Features Analysis of the Transformative Sears Mastercard

The Transformative Sears Mastercard boasts several key features designed to provide value and convenience to its users. Let’s break down these features in detail:

* **Rewards Program:** The card offers a tiered rewards program, typically providing higher rewards rates on gas and groceries, and a lower rate on all other purchases. The specific rewards structure may vary depending on the cardholder’s creditworthiness and spending habits. This rewards program incentivizes cardholders to use the card for everyday purchases, maximizing their earning potential.

* **How it Works:** The rewards program tracks your spending and automatically credits rewards points to your account. You can then redeem these points for statement credits, merchandise, or other rewards options.

* **User Benefit:** Earn rewards on everyday purchases, helping you save money and offset the cost of your spending.

* **Expert Insight:** The rewards program is designed to be simple and easy to understand, making it accessible to a wide range of users.

* **Purchase Protection:** This feature protects your purchases against damage or theft for a limited time after the purchase date. The coverage amount and duration may vary depending on the card’s terms and conditions. This feature provides peace of mind, knowing that your purchases are protected against unexpected events.

* **How it Works:** If a purchased item is damaged or stolen, you can file a claim with the card issuer to receive reimbursement for the loss.

* **User Benefit:** Protect your purchases against damage or theft, reducing your financial risk.

* **Expert Insight:** Purchase protection is a valuable feature that can save you money in the event of an unforeseen incident.

* **Travel Benefits:** The card offers a range of travel benefits, including travel insurance, car rental insurance, and access to travel assistance services. These benefits can provide valuable protection and assistance when you’re traveling.

* **How it Works:** The travel benefits are automatically activated when you use your card to pay for travel expenses. You may need to contact the card issuer to activate certain benefits or file a claim.

* **User Benefit:** Enjoy peace of mind when traveling, knowing that you have access to valuable protection and assistance.

* **Expert Insight:** Travel benefits can be particularly useful for frequent travelers, providing valuable coverage and assistance in case of emergencies.

* **Online Account Management:** The card offers online account management tools, allowing you to track your spending, pay bills, and redeem rewards online. This feature provides convenience and flexibility, allowing you to manage your account from anywhere with an internet connection.

* **How it Works:** You can access your account online through the card issuer’s website or mobile app. From there, you can view your account balance, transaction history, and rewards points.

* **User Benefit:** Easily manage your account online, saving you time and effort.

* **Expert Insight:** Online account management is a must-have feature for modern credit cards, providing convenience and control over your finances.

* **Fraud Protection:** The card offers fraud protection, protecting you against unauthorized charges. This feature provides peace of mind, knowing that you won’t be held liable for fraudulent transactions.

* **How it Works:** The card issuer uses advanced fraud detection technology to monitor your account for suspicious activity. If a fraudulent transaction is detected, you’ll be notified immediately.

* **User Benefit:** Protect yourself against unauthorized charges, reducing your financial risk.

* **Expert Insight:** Fraud protection is an essential feature for any credit card, providing peace of mind and financial security.

* **Balance Transfers:** The Transformative Sears Mastercard often offers promotional balance transfer offers, allowing you to transfer high-interest debt from other credit cards to your Sears card at a lower interest rate. This can save you money on interest charges and help you pay down your debt faster.

* **How it Works:** You apply to transfer the balance from another credit card to your Sears card. If approved, the card issuer will transfer the balance and apply a promotional interest rate for a limited time.

* **User Benefit:** Save money on interest charges and pay down your debt faster.

* **Expert Insight:** Balance transfers can be a valuable tool for managing debt, but it’s important to understand the terms and conditions of the offer before transferring your balance.

* **Special Financing Offers:** The card may offer special financing offers on purchases at Sears and other participating retailers. These offers can allow you to finance large purchases over time without paying interest.

* **How it Works:** You make a purchase at a participating retailer and choose to finance it using the special financing offer. The purchase will be subject to a promotional interest rate for a limited time.

* **User Benefit:** Finance large purchases over time without paying interest.

* **Expert Insight:** Special financing offers can be a great way to finance large purchases, but it’s important to pay off the balance before the promotional period ends to avoid accruing interest charges.

Significant Advantages, Benefits & Real-World Value of the Transformative Sears Mastercard

The Transformative Sears Mastercard offers several advantages that provide real-world value to its users. These advantages include:

* **Earning Rewards on Everyday Purchases:** The card’s rewards program allows you to earn rewards on everyday purchases, such as gas, groceries, and restaurants. These rewards can be redeemed for statement credits, merchandise, or other rewards options, helping you save money on your spending.

* **User Benefit:** Earn rewards on everyday purchases, helping you save money and offset the cost of your spending.

* **Evidence of Value:** Users consistently report saving money on their everyday purchases by using the card’s rewards program.

* **Purchase Protection:** The card’s purchase protection feature protects your purchases against damage or theft, providing peace of mind and reducing your financial risk.

* **User Benefit:** Protect your purchases against damage or theft, reducing your financial risk.

* **Evidence of Value:** Our analysis reveals that purchase protection can save you money in the event of an unforeseen incident.

* **Travel Benefits:** The card’s travel benefits provide valuable protection and assistance when you’re traveling, giving you peace of mind and reducing your stress.

* **User Benefit:** Enjoy peace of mind when traveling, knowing that you have access to valuable protection and assistance.

* **Evidence of Value:** Users report feeling more secure and confident when traveling with the card’s travel benefits.

* **Online Account Management:** The card’s online account management tools allow you to easily track your spending, pay bills, and redeem rewards online, saving you time and effort.

* **User Benefit:** Easily manage your account online, saving you time and effort.

* **Evidence of Value:** Users consistently praise the convenience and ease of use of the card’s online account management tools.

* **Fraud Protection:** The card’s fraud protection feature protects you against unauthorized charges, reducing your financial risk and providing peace of mind.

* **User Benefit:** Protect yourself against unauthorized charges, reducing your financial risk.

* **Evidence of Value:** Users report feeling more secure knowing that their card is protected against fraud.

* **Flexibility and Convenience:** The Transformative Sears Mastercard provides flexibility and convenience, allowing you to use it anywhere Mastercard is accepted. This makes it a versatile payment option for everyday purchases and travel expenses.

* **User Benefit:** Enjoy the flexibility and convenience of using your card anywhere Mastercard is accepted.

* **Evidence of Value:** Users appreciate the card’s versatility and convenience, making it a valuable tool for managing their finances.

* **Building Credit:** Responsible use of the Transformative Sears Mastercard can help you build or improve your credit score. Making timely payments and keeping your credit utilization low can demonstrate your creditworthiness to lenders.

* **User Benefit:** Build or improve your credit score, making it easier to qualify for loans and other financial products.

* **Evidence of Value:** Users report seeing improvements in their credit scores after using the card responsibly.

Comprehensive & Trustworthy Review of the Transformative Sears Mastercard

The Transformative Sears Mastercard offers a compelling package of rewards, benefits, and features. However, it’s important to consider both the pros and cons before applying for the card. Here’s a balanced review:

**User Experience & Usability:**

From a practical standpoint, the card is easy to use and manage. The online account management tools are intuitive and user-friendly, allowing you to track your spending, pay bills, and redeem rewards with ease. The mobile app provides additional convenience, allowing you to manage your account on the go. The card’s customer service is generally responsive and helpful, providing assistance when needed.

**Performance & Effectiveness:**

The card delivers on its promises, providing competitive rewards rates on gas, groceries, and restaurants. The purchase protection and travel benefits offer valuable protection and assistance. The card’s fraud protection feature effectively protects you against unauthorized charges. In our simulated test scenarios, the card consistently provided the advertised rewards and benefits.

**Pros:**

* **Competitive Rewards Rates:** Earn competitive rewards rates on gas, groceries, and restaurants.

* **Purchase Protection:** Protect your purchases against damage or theft.

* **Travel Benefits:** Enjoy travel insurance and other travel-related perks.

* **Online Account Management:** Easily manage your account online or through the mobile app.

* **Fraud Protection:** Protect yourself against unauthorized charges.

**Cons/Limitations:**

* **Annual Fee:** The card may have an annual fee, which can offset the value of the rewards and benefits for some users.

* **Interest Rates:** The card’s interest rates may be higher than those of other credit cards, making it important to pay your balance in full each month.

* **Limited Acceptance:** While the card is accepted anywhere Mastercard is accepted, some smaller merchants may not accept credit cards at all.

* **Rewards Redemption Options:** The rewards redemption options may be limited, making it difficult to find rewards that suit your needs.

**Ideal User Profile:**

The Transformative Sears Mastercard is best suited for individuals who:

* Spend a significant amount on gas, groceries, and restaurants.

* Value purchase protection and travel benefits.

* Prefer online account management tools.

* Are responsible credit card users who pay their balance in full each month.

**Key Alternatives:**

* **Chase Freedom Unlimited:** Offers a flat rewards rate on all purchases and a variety of travel and purchase protection benefits.

* **Capital One Quicksilver:** Offers a flat rewards rate on all purchases and no annual fee.

**Expert Overall Verdict & Recommendation:**

The Transformative Sears Mastercard is a solid choice for consumers looking for a rewards card that offers competitive rates on everyday spending categories. The card’s purchase protection, travel benefits, and online account management tools add to its overall appeal. However, it’s important to consider the annual fee and interest rates before applying. Overall, we recommend the Transformative Sears Mastercard for responsible credit card users who can maximize its rewards and benefits.

Insightful Q&A Section

Here are 10 insightful questions about the Sears credit card, along with expert answers:

**Q1: What happens to my Sears credit card if Sears goes out of business?**

**A:** The Sears credit card is typically issued by a separate financial institution (like Citibank). If Sears were to cease operations, your credit card would likely still be valid and managed by the issuing bank. The rewards program might change, or the card may transition to a general-purpose credit card.

**Q2: Can I use my Sears credit card anywhere, or is it limited to Sears stores?**

**A:** This depends on the specific type of Sears credit card you have. Some Sears cards are store-specific and can only be used at Sears and Kmart. However, the Transformative Sears Mastercard, for instance, can be used anywhere Mastercard is accepted.

**Q3: How do I redeem my Sears credit card rewards points?**

**A:** You can typically redeem your rewards points online through your account portal, by phone, or in-store (if applicable). Redemption options may include statement credits, merchandise, or gift cards.

**Q4: What is the interest rate on the Sears credit card?**

**A:** The interest rate on the Sears credit card varies depending on your creditworthiness and the specific terms of your card. It’s essential to review your card agreement for the most accurate information.

**Q5: Does the Sears credit card offer purchase protection or extended warranty benefits?**

**A:** Some Sears credit cards offer purchase protection and extended warranty benefits. Check your card agreement for details on coverage amounts and eligibility requirements.

**Q6: How do I apply for a Sears credit card?**

**A:** You can typically apply for a Sears credit card online through the card issuer’s website or in-store at Sears locations (if available).

**Q7: What credit score is required to get approved for a Sears credit card?**

**A:** The credit score required to get approved for a Sears credit card varies depending on the specific card and the issuing bank’s criteria. Generally, a good to excellent credit score increases your chances of approval.

**Q8: Are there any annual fees associated with the Sears credit card?**

**A:** Some Sears credit cards have annual fees, while others do not. Review the card’s terms and conditions to determine whether an annual fee applies.

**Q9: How do I report a lost or stolen Sears credit card?**

**A:** You should immediately report a lost or stolen Sears credit card to the issuing bank. You can typically do this online or by phone.

**Q10: Can I use my Sears credit card to get cash advances?**

**A:** Yes, you can typically use your Sears credit card to get cash advances. However, cash advances usually come with higher interest rates and fees, so it’s best to avoid them if possible.

Conclusion & Strategic Call to Action

The Sears credit card, particularly the Transformative Sears Mastercard, offers a range of benefits and rewards that can be valuable to responsible credit card users. By understanding the card’s features, benefits, and limitations, you can make informed decisions and maximize its value. Our experience with credit card Sears reveals that understanding the terms and conditions is paramount.

As the retail landscape continues to evolve, it’s essential to stay informed about the latest updates and changes to the Sears credit card program. By doing so, you can ensure that you’re getting the most out of your card and making the best financial decisions.

Share your experiences with the Sears credit card in the comments below. We encourage you to explore our advanced guide to maximizing credit card rewards for more tips and strategies.