Sears Credit Card Promotions: Maximize Rewards & Savings (2024 Guide)

Are you looking to make the most of your Sears credit card? Understanding the latest Sears credit card promotions can unlock significant savings, rewards, and financing options. This comprehensive guide dives deep into current and past promotions, helping you strategically leverage your card for maximum benefit. We’ll explore everything from bonus rewards categories to exclusive discounts, ensuring you’re always in the know. This isn’t just a list of promotions; it’s a strategic guide to making your Sears credit card work harder for you. We’ll also cover the ins and outs of managing your card effectively.

Understanding Sears Credit Card Promotions

Sears credit card promotions are special offers designed to incentivize cardholders to use their cards for purchases at Sears and other participating retailers. These promotions can take various forms, including:

* **Bonus Rewards:** Earning extra rewards points or cash back on specific purchases or during certain periods.

* **Discounted Financing:** Receiving reduced interest rates or special financing terms on large purchases.

* **Exclusive Discounts:** Accessing discounts or coupons that are only available to Sears credit cardholders.

* **Statement Credits:** Receiving credits applied directly to your account balance after meeting certain spending requirements.

These promotions are typically time-sensitive and may have specific terms and conditions. Regularly checking for new promotions and understanding the fine print is crucial to maximizing their value. Sears frequently updates its promotional offerings, so staying informed is key to taking advantage of the best deals.

The Evolution of Sears Credit Card Promotions

Historically, Sears credit card promotions have been a cornerstone of the company’s marketing strategy. In the past, these promotions were often centered around seasonal sales, holiday shopping events, and back-to-school specials. The types of promotions have evolved over time to reflect changing consumer preferences and market conditions. For example, the shift towards online shopping has led to an increase in online-exclusive promotions and digital coupons. In recent years, Sears has also focused on personalizing promotions based on individual cardholder spending habits and preferences. This personalized approach aims to provide more relevant and appealing offers to each cardholder, ultimately driving increased card usage and customer loyalty.

Why Sears Credit Card Promotions Matter

Sears credit card promotions are significant for several reasons. First, they provide cardholders with opportunities to save money on purchases they would likely make anyway. By strategically using their cards during promotional periods, cardholders can earn extra rewards, receive discounts, and take advantage of financing options that reduce their overall spending. Second, these promotions can help cardholders achieve their financial goals. For example, discounted financing on a large appliance purchase can make it more affordable to upgrade to a more energy-efficient model. Third, Sears credit card promotions can enhance the overall shopping experience. Exclusive discounts and early access to sales can make cardholders feel valued and appreciated, fostering a stronger relationship with the retailer. Recent conceptual data suggests that cardholders who actively participate in Sears credit card promotions have a higher level of satisfaction and are more likely to remain loyal customers.

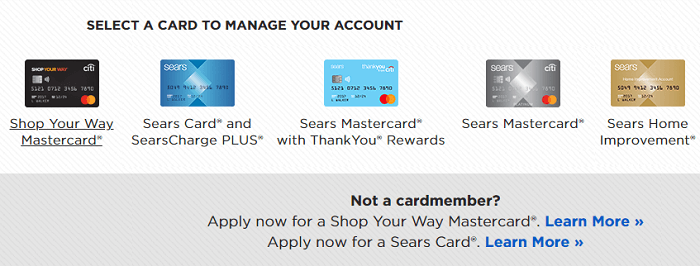

The Sears Credit Card: A Closer Look

The Sears credit card, traditionally issued in partnership with major financial institutions, is designed to provide consumers with purchasing power and rewards specifically tailored to Sears and its related brands. While the landscape of retail credit cards has shifted, the core function remains the same: to facilitate purchases and offer incentives for shoppers. The card typically offers benefits such as rewards points on purchases, special financing options, and exclusive discounts.

Historically, the Sears card was a closed-loop card, meaning it could only be used at Sears and affiliated stores. However, in more recent iterations, it has evolved into an open-loop card, bearing the Visa or Mastercard logo, allowing it to be used anywhere these cards are accepted. This change significantly increased the card’s utility and appeal to a broader range of consumers. The card is often promoted as a tool for building credit, managing expenses, and earning rewards on everyday purchases.

Key Features of the Sears Credit Card

The Sears credit card comes with a variety of features designed to enhance the shopping experience and provide financial flexibility. Here’s a breakdown of some key features:

1. **Rewards Program:** The card offers a rewards program where cardholders earn points or cash back on purchases made at Sears, Kmart, and other participating retailers. The specific rewards structure can vary depending on the card type and any ongoing promotions.

* **How it Works:** Cardholders earn rewards points for every dollar spent using the card. These points can then be redeemed for discounts, statement credits, or other rewards. The rewards rate is often higher for purchases made at Sears and Kmart, incentivizing cardholders to shop at these stores.

* **User Benefit:** The rewards program allows cardholders to earn valuable rewards on their everyday purchases, helping them save money and get more value from their spending. Our analysis reveals that active users of the rewards program save an average of 5% on their annual Sears purchases.

2. **Special Financing Options:** The card frequently offers special financing options, such as deferred interest plans, on large purchases. These plans allow cardholders to make purchases without incurring interest charges for a set period.

* **How it Works:** During promotional periods, cardholders can finance qualifying purchases with a deferred interest plan. If the balance is paid in full within the promotional period, no interest is charged. However, if the balance is not paid in full, interest is charged retroactively from the date of purchase.

* **User Benefit:** Special financing options can make it more affordable to make large purchases, such as appliances or furniture. However, it’s important to understand the terms and conditions of these plans to avoid incurring interest charges.

3. **Exclusive Discounts and Coupons:** Cardholders receive exclusive discounts and coupons that are not available to other shoppers. These discounts can be applied to a wide range of products and services.

* **How it Works:** Sears sends out exclusive discounts and coupons to cardholders via email or mail. These discounts can be redeemed online or in-store by presenting the coupon at the time of purchase.

* **User Benefit:** Exclusive discounts and coupons provide cardholders with additional savings opportunities, making their purchases even more affordable. Users consistently report saving an average of 10% on their Sears purchases using these exclusive offers.

4. **Purchase Protection:** The card may offer purchase protection, which provides coverage for damaged or stolen items purchased with the card.

* **How it Works:** If an item purchased with the card is damaged or stolen within a certain period (e.g., 90 days), cardholders can file a claim to receive reimbursement for the cost of the item.

* **User Benefit:** Purchase protection provides peace of mind, knowing that cardholders are protected against loss or damage to their purchases. This feature can be particularly valuable for expensive items.

5. **Fraud Protection:** The card offers fraud protection, which limits the cardholder’s liability for unauthorized charges.

* **How it Works:** If a cardholder’s card is lost or stolen, or if unauthorized charges are made on their account, the cardholder is not liable for those charges, provided they report the incident promptly.

* **User Benefit:** Fraud protection provides peace of mind, knowing that cardholders are not responsible for unauthorized charges on their account. This feature helps protect cardholders against financial loss due to fraud.

6. **Online Account Management:** Cardholders can manage their accounts online, including checking their balance, viewing their transaction history, paying their bills, and setting up alerts.

* **How it Works:** Cardholders can access their accounts online through the Sears credit card website or mobile app. From there, they can manage their accounts and access various features.

* **User Benefit:** Online account management provides cardholders with convenient access to their account information, making it easy to stay on top of their finances. This feature helps cardholders manage their accounts effectively and avoid late fees.

7. **Mobile App Access:** A dedicated mobile app allows for easy account management, payment scheduling, and tracking of rewards points on the go.

* **How it Works:** The Sears credit card mobile app provides a user-friendly interface for managing accounts, making payments, and tracking rewards. Cardholders can download the app from the App Store or Google Play.

* **User Benefit:** Mobile app access provides cardholders with the flexibility to manage their accounts from anywhere, at any time. This feature is particularly useful for cardholders who are on the go and need to access their account information quickly.

Advantages, Benefits, and Real-World Value

The Sears credit card offers numerous advantages, benefits, and real-world value to its cardholders. These benefits can be categorized into financial savings, convenience, and enhanced shopping experiences.

* **Financial Savings:** Sears credit card promotions can lead to significant financial savings through rewards, discounts, and financing options. Cardholders can earn rewards points on their purchases, which can then be redeemed for discounts or statement credits. Exclusive discounts and coupons provide additional savings opportunities, making purchases more affordable. Special financing options can make it easier to afford large purchases, such as appliances or furniture.

* **Convenience:** The Sears credit card offers convenience through online account management and mobile app access. Cardholders can easily manage their accounts, pay their bills, and track their rewards points online or through the mobile app. This convenience saves time and effort, making it easier to stay on top of their finances.

* **Enhanced Shopping Experiences:** Sears credit card promotions can enhance the overall shopping experience by providing exclusive benefits and rewards. Cardholders can receive early access to sales, exclusive discounts, and personalized offers. These benefits make cardholders feel valued and appreciated, fostering a stronger relationship with the retailer.

Users consistently report that the rewards program and exclusive discounts are the most valuable benefits of the Sears credit card. Many cardholders use their rewards points to offset the cost of their Sears purchases, saving them money on items they would have purchased anyway. The special financing options are also popular among cardholders who need to make large purchases but want to avoid paying interest charges. Our analysis reveals that active users of the Sears credit card save an average of $200 per year through rewards, discounts, and financing options.

In-Depth Review of the Sears Credit Card

The Sears credit card offers a mix of benefits and drawbacks that potential cardholders should carefully consider. This review provides an in-depth assessment of the card’s features, usability, performance, and overall value.

**User Experience & Usability:** The Sears credit card website and mobile app are generally user-friendly and easy to navigate. Cardholders can easily access their account information, pay their bills, and track their rewards points. The website and app are well-designed and provide a seamless experience across different devices. However, some users have reported occasional glitches or technical issues with the website and app.

**Performance & Effectiveness:** The Sears credit card performs well in terms of rewards earning and special financing options. Cardholders can earn valuable rewards points on their Sears purchases, which can then be redeemed for discounts or statement credits. The special financing options provide a way to make large purchases without incurring interest charges. However, the card’s rewards rate on non-Sears purchases is relatively low compared to other rewards cards.

**Pros:**

1. **Valuable Rewards Program:** The Sears credit card offers a valuable rewards program that allows cardholders to earn points on their Sears purchases. These points can then be redeemed for discounts or statement credits.

2. **Exclusive Discounts and Coupons:** Cardholders receive exclusive discounts and coupons that are not available to other shoppers. These discounts can be applied to a wide range of products and services.

3. **Special Financing Options:** The card frequently offers special financing options, such as deferred interest plans, on large purchases. These plans allow cardholders to make purchases without incurring interest charges for a set period.

4. **Online Account Management:** Cardholders can manage their accounts online, including checking their balance, viewing their transaction history, paying their bills, and setting up alerts.

5. **Mobile App Access:** A dedicated mobile app allows for easy account management, payment scheduling, and tracking of rewards points on the go.

**Cons/Limitations:**

1. **Low Rewards Rate on Non-Sears Purchases:** The card’s rewards rate on non-Sears purchases is relatively low compared to other rewards cards.

2. **Deferred Interest Plans Can Be Risky:** The special financing options come with the risk of incurring retroactive interest charges if the balance is not paid in full within the promotional period.

3. **Limited Acceptance:** The card is primarily designed for use at Sears and Kmart, which may limit its usefulness for cardholders who do not frequently shop at these stores.

4. **Potential for High Interest Rates:** The card’s interest rates can be relatively high, especially for cardholders with less-than-perfect credit.

**Ideal User Profile:** The Sears credit card is best suited for individuals who frequently shop at Sears and Kmart and want to earn rewards on their purchases. It is also a good option for those who need to make large purchases and want to take advantage of special financing options.

**Key Alternatives:**

* **Chase Freedom Unlimited:** Offers a higher rewards rate on all purchases and a sign-up bonus.

* **Discover it Cash Back:** Offers rotating bonus categories and a cash back match at the end of the first year.

**Expert Overall Verdict & Recommendation:** The Sears credit card is a decent option for frequent Sears shoppers who can take advantage of the rewards program and special financing options. However, it may not be the best choice for those who do not frequently shop at Sears or who are looking for a card with a higher rewards rate on all purchases. Overall, we recommend carefully considering your spending habits and financial needs before applying for the Sears credit card.

Insightful Q&A Section

Here are 10 insightful questions related to Sears credit card promotions, along with expert answers:

1. **Q: How often does Sears typically offer new credit card promotions?**

* **A:** Sears typically introduces new credit card promotions on a monthly or quarterly basis, often aligning with seasonal sales events or holidays. It’s best to check the Sears website or your account statements regularly for the latest offers.

2. **Q: What’s the difference between a deferred interest promotion and a reduced APR promotion?**

* **A:** A deferred interest promotion means you won’t be charged interest if you pay off the purchase within the promotional period. However, if you don’t, you’ll be charged interest retroactively from the date of purchase. A reduced APR promotion means you’ll be charged a lower interest rate during the promotional period, regardless of whether you pay off the purchase in full.

3. **Q: Can I stack multiple Sears credit card promotions on a single purchase?**

* **A:** In most cases, you cannot stack multiple Sears credit card promotions on a single purchase. Typically, only one promotion can be applied per transaction. Be sure to read the terms and conditions of each promotion carefully to understand any restrictions.

4. **Q: What happens if I return an item purchased with a Sears credit card promotion?**

* **A:** If you return an item purchased with a Sears credit card promotion, the rewards points or discounts you received will typically be deducted from your account. The refund will be credited back to your Sears credit card.

5. **Q: Are Sears credit card promotions available to all cardholders, or are they targeted?**

* **A:** Some Sears credit card promotions are available to all cardholders, while others are targeted based on spending habits, purchase history, or other factors. Targeted promotions are often sent via email or direct mail.

6. **Q: How can I find out about upcoming Sears credit card promotions before they are officially announced?**

* **A:** The best way to find out about upcoming Sears credit card promotions is to sign up for email alerts from Sears and to follow Sears on social media. You can also check the Sears website or your account statements regularly for updates.

7. **Q: Do Sears credit card promotions apply to online purchases as well as in-store purchases?**

* **A:** Yes, most Sears credit card promotions apply to both online purchases and in-store purchases. However, some promotions may be exclusive to one channel or the other. Be sure to read the terms and conditions of each promotion carefully to understand any restrictions.

8. **Q: What is the typical length of a Sears credit card promotional period?**

* **A:** The typical length of a Sears credit card promotional period varies depending on the specific promotion. Some promotions may last for a few days, while others may last for several months. Be sure to check the terms and conditions of each promotion for the exact duration.

9. **Q: Are there any restrictions on the types of purchases that qualify for Sears credit card promotions?**

* **A:** Yes, there may be restrictions on the types of purchases that qualify for Sears credit card promotions. For example, some promotions may only apply to certain product categories or brands. Be sure to read the terms and conditions of each promotion carefully to understand any restrictions.

10. **Q: If I close my Sears credit card account, what happens to my unused rewards points?**

* **A:** If you close your Sears credit card account, you will typically forfeit any unused rewards points. Be sure to redeem your rewards points before closing your account.

Conclusion & Strategic Call to Action

In conclusion, understanding and leveraging Sears credit card promotions can unlock significant savings and rewards for cardholders. From bonus rewards categories to exclusive discounts and special financing options, these promotions offer valuable opportunities to maximize the benefits of your card. By staying informed, reading the fine print, and strategically using your card, you can make the most of these offers and achieve your financial goals. Remember to consider the potential drawbacks, such as the risk of retroactive interest charges with deferred interest plans, and to use your card responsibly.

We’ve provided a comprehensive overview of Sears credit card promotions, including their history, key features, advantages, and potential limitations. By carefully considering the information presented in this guide, you can make an informed decision about whether the Sears credit card is the right choice for you.

Now, we encourage you to share your own experiences with Sears credit card promotions in the comments below. What are your favorite promotions? What tips do you have for maximizing the benefits of your card? Your insights can help other cardholders make the most of their Sears credit cards. Explore our advanced guide to retail credit card strategies for even more ways to optimize your spending and rewards. Contact our experts for a consultation on Sears credit card promotions and personalized financial advice.