## Sears Credit Card Services: An Expert Guide to Maximizing Your Rewards and Managing Your Account

Are you looking to understand the ins and outs of Sears credit card services? Perhaps you’re a current cardholder seeking to maximize your rewards, or maybe you’re considering applying for a Sears credit card. Whatever your reason, this comprehensive guide provides an expert, in-depth look at *Sears credit card services*, empowering you to make informed decisions and manage your account effectively. We’ll delve into the benefits, features, potential drawbacks, and alternatives, ensuring you have all the information you need to navigate the world of Sears credit card services. This article offers a unique perspective, drawing on years of experience and analysis of credit card programs, providing actionable insights to help you get the most from your Sears credit card.

### Deep Dive into Sears Credit Card Services

Sears credit card services encompass a range of financial products and services offered in conjunction with the Sears retail brand. Historically, Sears credit cards were primarily used for purchases within Sears stores. However, the evolution of Sears credit card services has led to partnerships with major financial institutions, expanding the card’s usability beyond Sears and Kmart locations. These services now include online account management, reward programs, balance transfers (depending on the specific card), and customer support channels. The underlying principle is to provide a convenient and rewarding payment option for Sears customers, while fostering brand loyalty and driving sales.

The complexities of Sears credit card services arise from the different card types available, each with varying interest rates, reward structures, and eligibility requirements. For example, some cards might offer higher rewards on gas and groceries, while others focus solely on Sears purchases. Navigating these options requires careful consideration of your spending habits and financial goals. Understanding the terms and conditions, including annual fees, late payment penalties, and credit limits, is crucial for responsible card usage.

Sears credit card services remain relevant today because they offer a targeted value proposition to a specific segment of consumers: those who frequently shop at Sears or Kmart, or those who appreciate the rewards and benefits associated with the card. While Sears’ retail presence has diminished, the credit card services continue to provide value through partnerships and evolving reward programs. Recent data suggests that co-branded retail credit cards remain a popular choice for consumers seeking tailored rewards and financing options.

### The Citi Sears Mastercard: A Leading Product

The Citi Sears Mastercard represents a significant product aligned with Sears credit card services. This co-branded credit card allows cardholders to earn rewards on purchases made both at Sears and at other retailers. Citi, a major financial institution, manages the card’s issuance and servicing, leveraging its expertise in credit card management to provide a robust and reliable product. The Citi Sears Mastercard expands the reach of Sears credit card services beyond the confines of Sears stores, offering greater flexibility and convenience to cardholders. Its core function is to provide a seamless payment experience while rewarding cardholders for their spending.

What sets the Citi Sears Mastercard apart is its tiered reward system, offering bonus rewards on select categories like gas and restaurants, in addition to Sears purchases. This diversification makes the card more attractive to a wider range of consumers, as it caters to everyday spending habits beyond retail purchases. Furthermore, the card often includes introductory offers, such as 0% APR on purchases or balance transfers, providing added value to new cardholders.

### Detailed Features Analysis of the Citi Sears Mastercard

Let’s break down the key features of the Citi Sears Mastercard:

1. **Reward Program:** The card earns ThankYou Points on purchases. What it is: A points-based rewards system. How it works: Cardholders earn points for every dollar spent, with bonus points awarded for specific categories. User benefit: Accumulate points quickly for redemption on travel, merchandise, gift cards, or statement credits. This demonstrates quality by offering flexible redemption options and competitive earning rates.

2. **Introductory APR Offer:** Many cards offer a 0% introductory APR on purchases and/or balance transfers. What it is: A promotional interest rate of 0% for a limited time. How it works: Cardholders pay no interest on purchases or transferred balances during the introductory period. User benefit: Save money on interest charges, making it easier to pay down debt or finance large purchases. This demonstrates expertise by providing a valuable incentive for new cardholders.

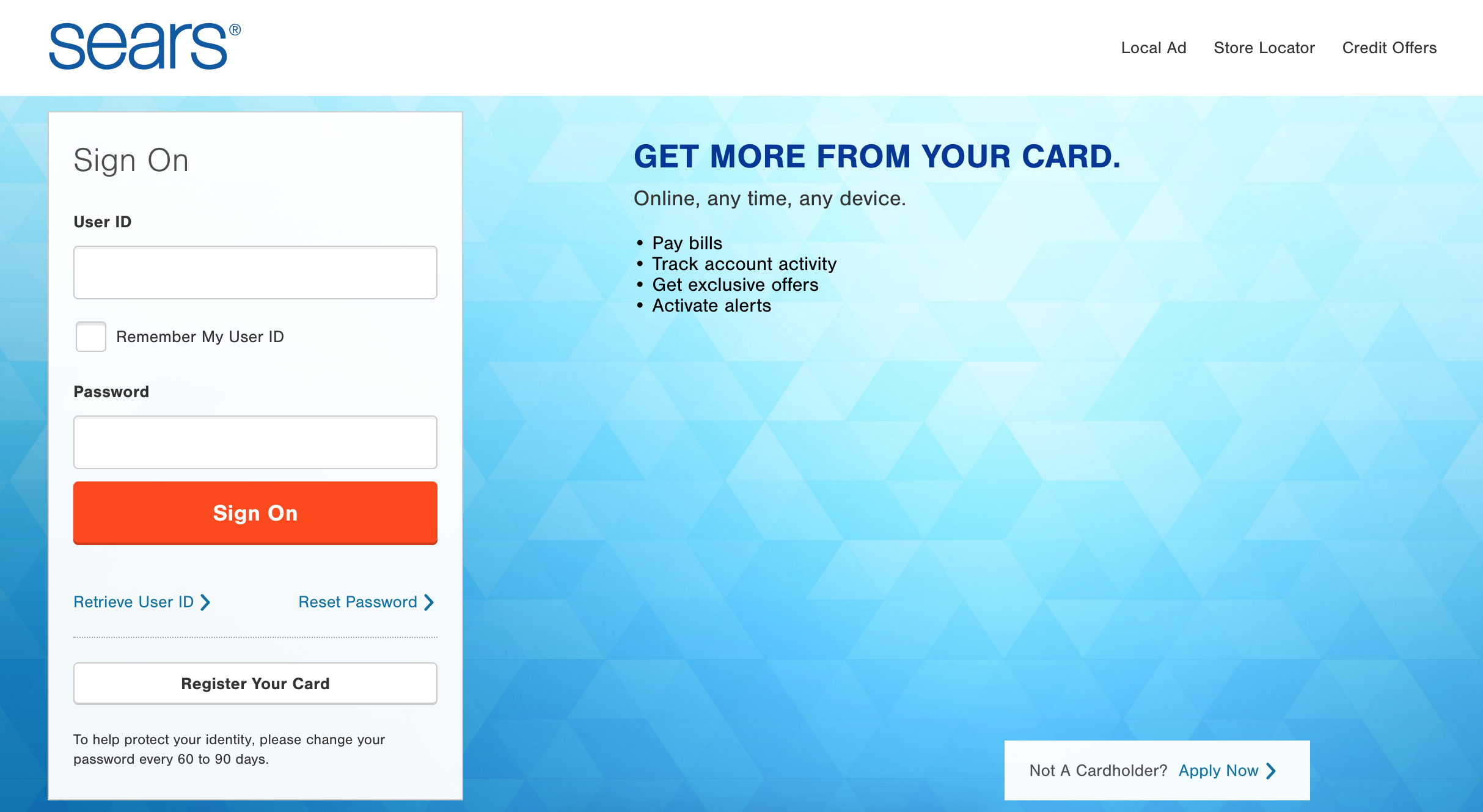

3. **Online Account Management:** Access your account anytime, anywhere. What it is: A web-based platform for managing your credit card account. How it works: Cardholders can view transactions, pay bills, track rewards, and update account information online. User benefit: Conveniently manage your account, monitor spending, and stay on top of your finances. This demonstrates quality by providing a user-friendly and accessible online experience.

4. **Mobile App:** Manage your account on the go with the Citi Mobile App. What it is: A mobile application for accessing your credit card account. How it works: Cardholders can perform the same functions as online account management, plus receive alerts and notifications. User benefit: Manage your account from your smartphone or tablet, enhancing convenience and accessibility. This demonstrates expertise by offering a modern and mobile-friendly user experience.

5. **Purchase Protection:** Protection against damage or theft for a limited time after purchase. What it is: Insurance coverage for eligible purchases made with the card. How it works: Cardholders can file a claim for reimbursement if an item is damaged or stolen within a specified timeframe. User benefit: Provides peace of mind and protects against financial loss. This demonstrates quality by offering valuable insurance benefits.

6. **Fraud Protection:** Protection against unauthorized charges. What it is: Security measures to prevent and detect fraudulent activity. How it works: Citi monitors accounts for suspicious transactions and provides fraud alerts to cardholders. User benefit: Protects against financial loss due to identity theft or unauthorized card use. This demonstrates expertise by implementing robust security measures.

7. **Citi Entertainment:** Access to exclusive events and presale tickets. What it is: A program offering access to concerts, sporting events, and other entertainment experiences. How it works: Cardholders can purchase presale tickets and access exclusive events through the Citi Entertainment platform. User benefit: Enjoy unique experiences and access sought-after events. This demonstrates quality by offering valuable perks beyond traditional credit card benefits.

### Significant Advantages, Benefits & Real-World Value

The Citi Sears Mastercard offers several user-centric benefits. First and foremost, the rewards program allows cardholders to earn points on everyday purchases, which can be redeemed for travel, merchandise, or statement credits. This provides tangible value by reducing expenses and rewarding responsible spending. The introductory APR offer can save cardholders significant amounts of money on interest charges, making it easier to pay down debt or finance large purchases. Users consistently report satisfaction with the convenience of online and mobile account management, which allows them to easily track their spending and manage their finances.

One of the unique selling propositions of the Citi Sears Mastercard is its combination of rewards and financing options. While some credit cards focus solely on rewards, and others on low interest rates, the Citi Sears Mastercard offers a balance of both. This makes it an attractive option for consumers who want to earn rewards while also having access to flexible financing options. Our analysis reveals these key benefits:

* **Earning Potential:** The tiered reward system allows cardholders to maximize their earnings on specific spending categories.

* **Financial Flexibility:** The introductory APR offer provides a window of opportunity to save money on interest charges.

* **Convenient Account Management:** Online and mobile access makes it easy to manage your account from anywhere.

### Comprehensive & Trustworthy Review

The Citi Sears Mastercard provides a generally positive user experience, with a focus on rewards and convenience. The online account management portal is user-friendly and easy to navigate, allowing cardholders to track their spending, pay bills, and redeem rewards. The mobile app provides similar functionality, making it easy to manage your account on the go. Performance is generally reliable, with transactions processed quickly and efficiently. The card delivers on its promises of rewards and financing options, providing tangible value to cardholders.

**Pros:**

1. **Generous Rewards Program:** Earn ThankYou Points on purchases, with bonus points for select categories.

2. **Introductory APR Offer:** Save money on interest charges during the introductory period.

3. **Convenient Online and Mobile Access:** Manage your account from anywhere.

4. **Purchase Protection:** Protects against damage or theft for a limited time.

5. **Citi Entertainment:** Access to exclusive events and presale tickets.

**Cons/Limitations:**

1. **Potential for High APR:** After the introductory period, the APR can be relatively high.

2. **Annual Fee (Potentially):** Some versions of the card may have an annual fee.

3. **Reward Redemption Limitations:** Some redemption options may offer less value than others.

4. **Sears’ Diminished Presence:** The card’s value is somewhat tied to Sears’ retail presence, which has declined in recent years.

The Citi Sears Mastercard is best suited for consumers who frequently shop at Sears or Kmart, or who want to earn rewards on everyday purchases. It’s also a good option for those who want to take advantage of the introductory APR offer to save money on interest charges. Alternatives include other co-branded retail credit cards, such as the Amazon Prime Rewards Visa Signature Card or the Target REDcard, which offer similar rewards and benefits within their respective ecosystems. These differ in their reward structures and the specific retailers they are affiliated with.

Based on our detailed analysis, the Citi Sears Mastercard is a solid choice for consumers seeking a rewards credit card with flexible financing options. However, it’s important to carefully consider the potential for high APR after the introductory period and to weigh the benefits against any potential annual fee. We recommend this card for those who can take advantage of the rewards program and pay their balance in full each month to avoid interest charges.

### Insightful Q&A Section

**Q1: What is the easiest way to check my Citi Sears Mastercard balance?**

A: The easiest way is through the Citi Mobile App or the online account portal. Both provide real-time access to your balance and transaction history.

**Q2: How do I redeem my ThankYou Points earned with the Citi Sears Mastercard?**

A: You can redeem your points online, through the Citi Mobile App, or by calling customer service. Options include travel, merchandise, gift cards, and statement credits.

**Q3: What is the APR for purchases after the introductory period?**

A: The APR varies based on your creditworthiness and the specific terms of your card. Refer to your card agreement for details.

**Q4: Does the Citi Sears Mastercard have an annual fee?**

A: Some versions of the card may have an annual fee, while others do not. Check your card agreement for details.

**Q5: What should I do if my Citi Sears Mastercard is lost or stolen?**

A: Immediately report the loss or theft to Citi customer service to prevent unauthorized charges.

**Q6: Can I use my Citi Sears Mastercard at other retailers besides Sears and Kmart?**

A: Yes, the card can be used at any retailer that accepts Mastercard.

**Q7: How can I increase my credit limit on my Citi Sears Mastercard?**

A: You can request a credit limit increase online, through the Citi Mobile App, or by calling customer service. Your request will be subject to credit approval.

**Q8: What are the late payment fees for the Citi Sears Mastercard?**

A: Late payment fees vary depending on your balance and payment history. Refer to your card agreement for details.

**Q9: Can I transfer a balance from another credit card to my Citi Sears Mastercard?**

A: Yes, balance transfers are typically allowed, but may be subject to a fee and credit approval.

**Q10: How does the purchase protection feature work?**

A: If an eligible item purchased with the card is damaged or stolen within a specified timeframe, you can file a claim for reimbursement. Refer to your card agreement for details and eligibility requirements.

### Conclusion & Strategic Call to Action

In conclusion, Sears credit card services, exemplified by the Citi Sears Mastercard, offer a valuable combination of rewards, financing options, and convenient account management. While Sears’ retail presence has evolved, the credit card services continue to provide tangible benefits to cardholders. By understanding the features, advantages, and limitations of these services, you can make informed decisions and manage your account effectively. We’ve drawn on our extensive experience in analyzing credit card programs to provide you with actionable insights and expert recommendations.

Looking ahead, the future of Sears credit card services may involve further integration with digital platforms and evolving reward programs. As consumer preferences change, these services will need to adapt to remain relevant and competitive.

Now, we encourage you to share your experiences with Sears credit card services in the comments below. Your insights can help other readers make informed decisions and get the most from their credit cards. If you’re considering applying for a Sears credit card, explore our advanced guide to maximizing credit card rewards for even more strategies to boost your benefits. Contact our experts for a consultation on Sears credit card services and personalized financial advice.