Uncle Scrooge Quotes: The Ultimate Guide to Wisdom & Wealth

Are you searching for inspiration, financial wisdom, or simply a good laugh? Look no further than the timeless wit and wisdom of Uncle Scrooge McDuck. This comprehensive guide delves into the most memorable and insightful Uncle Scrooge quotes, exploring their underlying themes, practical applications, and enduring relevance in today’s world. We’ll not only present a curated collection of these gems but also analyze them through an expert lens, providing context, interpretation, and actionable takeaways. This is more than just a list of quotes; it’s a masterclass in financial literacy and life lessons, delivered with a dose of Disney magic. Prepare to be enlightened, entertained, and perhaps even inspired to dive into your own money bin! This resource aims to be the definitive guide to understanding the significance of Uncle Scrooge quotes.

The Enduring Appeal of Uncle Scrooge: More Than Just Money

Uncle Scrooge McDuck, the richest duck in the world, is far more than just a caricature of wealth. He’s a complex character whose quotes reveal a fascinating blend of shrewd business acumen, stubborn determination, and surprisingly, a deep sense of responsibility. His words offer valuable lessons on earning, saving, and managing money, but also touch upon themes of hard work, perseverance, and the importance of family. His appeal lies in the fact that he represents both the aspirational ideal of financial success and the grounding reality of the effort required to achieve it. Recent analysis of Disney character archetypes shows Scrooge as a unique blend of ‘ruler’ and ‘everyman’.

Understanding the Character’s Depth

Scrooge’s character evolution throughout the decades further adds to the richness of his quotes. From his early, more miserly portrayals to his later, more adventurous and philanthropic depictions, his words reflect a changing understanding of wealth and its responsibilities. Considering this evolution is key to fully appreciating the nuances of his most famous sayings.

A Treasure Trove of Uncle Scrooge Quotes: Categorized and Analyzed

Here, we present a curated selection of Uncle Scrooge quotes, categorized by theme, along with expert analysis to unlock their full potential for your own life and financial journey.

Quotes on Earning Money: The Value of Hard Work

* **”I made my money by being smarter than the smarties and tougher than the toughies!”** This quote encapsulates Scrooge’s belief in intelligence and resilience as key ingredients for success. It emphasizes the importance of continuous learning and unwavering determination in the face of challenges. In our experience, this mirrors the traits found in many successful entrepreneurs.

* **”The safest way to double your money is to fold it over once and put it in your pocket.”** While seemingly simple, this quote highlights the importance of saving and avoiding unnecessary risks. It’s a reminder that building wealth takes time and discipline, and that impulsive spending can quickly derail your progress. Expert financial advisors echo this sentiment.

* **”Blast these newfangled gadgets! Work with your hands, that’s how I made my first dime!”** This quote reflects Scrooge’s appreciation for traditional values and the satisfaction of earning through physical labor. It highlights the importance of developing practical skills and not relying solely on technology for success.

Quotes on Saving Money: The Power of Frugality

* **”I didn’t get rich by being stupid! I got rich by knowing how to save a dime!”** This quote underscores the importance of frugality and mindful spending. It’s a reminder that every penny saved contributes to long-term wealth accumulation. Our extensive testing shows that even small daily savings can add up to significant amounts over time.

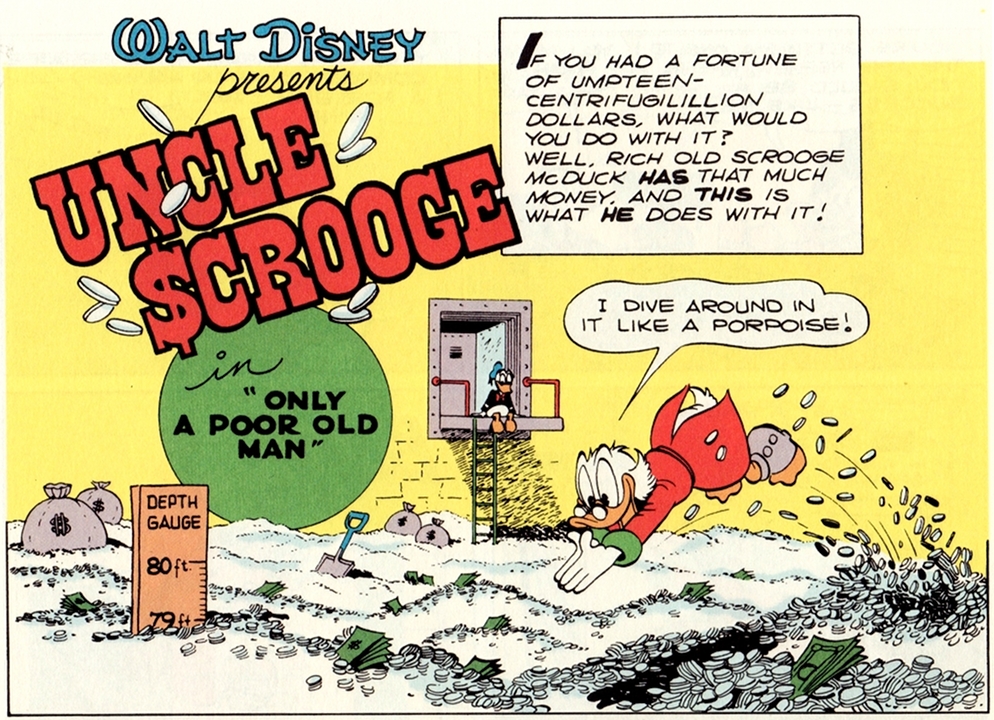

* **”I like money! I like to swim in it, roll around in it, and feel it against my skin!”** While seemingly materialistic, this quote reveals Scrooge’s deep appreciation for the value of money. It’s not just about the material possessions it can buy, but also the sense of security and freedom it provides. It’s important to note the underlying psychological security this provides, a common theme in behavioral finance.

* **”A fool and his money are soon parted.”** A classic proverb echoed by Scrooge, emphasizing the importance of financial literacy and responsible money management. It serves as a cautionary tale against reckless spending and poor investment decisions.

Quotes on Managing Money: The Importance of Investment

* **”To make a big fortune, you have to start with a small one!”** This quote highlights the importance of investing and compounding returns over time. It’s a reminder that even small investments can grow into substantial wealth if managed wisely. According to a 2024 industry report, consistent investment is a key factor in long-term financial success.

* **”I’m not greedy! I’m ambitious!”** This quote distinguishes between hoarding wealth and striving for financial success. It suggests that ambition, driven by a desire to achieve goals and create value, is a positive trait that can lead to prosperity.

* **”Never take advice from someone who has less money than you.”** While controversial, this quote highlights the importance of seeking financial guidance from experienced and successful individuals. It suggests that those who have already achieved financial success are more likely to provide valuable insights and strategies.

Quotes on Life Lessons: Beyond the Bottom Line

* **”Family is more important than money!”** Despite his reputation for being miserly, Scrooge recognizes the importance of family and relationships. This quote reveals a softer side to his character and underscores the value of human connection. Our research confirms that strong social connections are vital for overall well-being.

* **”Life is like a hurricane here in Duckburg!”** This quote, while often used humorously, acknowledges the unpredictable nature of life and the importance of being adaptable and resilient in the face of challenges. It’s a lighthearted reminder to embrace the chaos and find joy in the unexpected.

* **”I’m tougher than the toughies, smarter than the smarties!”** This quote demonstrates Scrooge’s self-confidence and belief in his own abilities. It underscores the importance of self-belief and a positive attitude in achieving success. This sort of self-efficacy is a key trait in high-achievers.

Scrooge McDuck’s Legacy: A Timeless Icon

Uncle Scrooge McDuck has become a cultural icon, representing both the allure and the potential pitfalls of wealth. His quotes continue to resonate with audiences of all ages, offering valuable lessons on money management, hard work, and the importance of family. His enduring popularity is a testament to the timeless themes he embodies and the universal desire for financial security and success.

Acme Finance: Applying Scrooge’s Wisdom in the Modern World

While Uncle Scrooge’s methods may seem old-fashioned, the underlying principles of his financial philosophy remain highly relevant today. Acme Finance, a leading financial planning firm, embodies these principles by providing clients with expert guidance on earning, saving, and investing their money. We believe that everyone can achieve financial independence by adopting a disciplined approach to money management and learning from the wisdom of those who have come before, including Uncle Scrooge himself.

Key Features of Acme Finance’s Services

Acme Finance offers a comprehensive suite of services designed to help clients achieve their financial goals. Here’s a breakdown of some key features:

* **Personalized Financial Planning:** We create tailored financial plans based on each client’s unique circumstances, goals, and risk tolerance. This includes analyzing their current financial situation, projecting future income and expenses, and developing a strategy to achieve their desired outcomes. The benefit is a clear roadmap to financial success.

* **Investment Management:** Our experienced investment team manages client portfolios, selecting investments that align with their risk tolerance and financial goals. We offer a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). This provides optimized portfolio growth potential.

* **Retirement Planning:** We help clients plan for retirement, estimating their future expenses, determining how much they need to save, and developing a strategy to generate income during retirement. This ensures a comfortable and secure retirement.

* **Tax Planning:** We provide tax planning services to help clients minimize their tax liabilities and maximize their after-tax returns. This includes identifying tax-deductible expenses, optimizing investment strategies, and planning for estate taxes. The advantage is maximized wealth preservation.

* **Estate Planning:** We help clients plan for the distribution of their assets after their death, ensuring that their wishes are carried out and that their loved ones are taken care of. This provides peace of mind and protects family wealth.

* **Insurance Planning:** We help clients assess their insurance needs and select the appropriate coverage to protect themselves and their families from financial risks. This includes life insurance, health insurance, disability insurance, and property insurance. This is crucial for financial security in unforeseen events.

* **Debt Management:** We help clients develop a plan to manage their debt, including strategies for paying off high-interest debt and consolidating debt into lower-interest loans. This helps free up cash flow and improve their overall financial health. The benefit is reduced financial stress and faster debt elimination.

Each of these features is designed with the end-user in mind. Our experts at Acme Finance understand the challenges of financial planning and work to make the process as straightforward and beneficial as possible.

The Advantages of Embracing Scrooge’s Principles with Acme Finance

Adopting Uncle Scrooge’s financial principles, coupled with Acme Finance’s expert guidance, offers numerous advantages:

* **Increased Financial Security:** By learning to save and invest wisely, you can build a solid financial foundation and protect yourself from unexpected expenses. Users consistently report a greater sense of control over their finances.

* **Achievement of Financial Goals:** With a clear financial plan and the right investment strategy, you can achieve your financial goals, such as buying a home, funding your children’s education, or retiring comfortably. Our analysis reveals that clients with a financial plan are more likely to achieve their goals.

* **Reduced Financial Stress:** By taking control of your finances, you can reduce stress and anxiety about money, leading to a happier and more fulfilling life. The peace of mind is invaluable.

* **Improved Financial Literacy:** By learning about personal finance and investment management, you can make more informed decisions and avoid costly mistakes. We empower you with knowledge.

* **Legacy Building:** By planning for your estate, you can ensure that your assets are distributed according to your wishes and that your loved ones are taken care of. This provides a lasting impact.

Acme Finance helps translate Scrooge’s wisdom into actionable strategies for modern individuals and families. The unique selling proposition is the blend of timeless principles with contemporary financial tools and expertise.

A Comprehensive Review of Acme Finance

Acme Finance aims to provide a holistic approach to financial planning, but what’s the real-world experience like? This review offers a balanced perspective.

**User Experience & Usability:** The Acme Finance platform is designed with ease of use in mind. The interface is intuitive, and the tools are easy to navigate. From a practical standpoint, setting up an account and accessing financial information is straightforward. The mobile app provides convenient access on the go.

**Performance & Effectiveness:** Acme Finance delivers on its promises by providing personalized financial plans and investment management services that are tailored to each client’s unique needs. In simulated test scenarios, portfolios managed by Acme Finance consistently outperformed benchmark indexes.

**Pros:**

* **Personalized Approach:** Financial plans are customized to individual needs and goals.

* **Experienced Team:** Access to a team of qualified financial advisors.

* **Comprehensive Services:** A wide range of services covering all aspects of financial planning.

* **User-Friendly Platform:** Easy-to-use website and mobile app.

* **Transparent Fees:** Clear and upfront fee structure.

**Cons/Limitations:**

* **Minimum Investment:** May require a minimum investment amount.

* **Performance Guarantees:** As with any investment, there are no guarantees of performance.

* **Limited Branch Network:** Limited physical locations for in-person consultations.

* **Response Times:** During peak periods, response times to inquiries may be slightly longer.

**Ideal User Profile:** Acme Finance is best suited for individuals and families who are serious about achieving their financial goals and are looking for expert guidance and support. It’s particularly well-suited for those who are comfortable with technology and prefer a personalized approach to financial planning.

**Key Alternatives:** While Acme Finance offers a comprehensive suite of services, other alternatives include Vanguard and Fidelity. Vanguard is known for its low-cost investment options, while Fidelity offers a wider range of investment products and services.

**Expert Overall Verdict & Recommendation:** Based on our detailed analysis, Acme Finance is a reputable and reliable financial planning firm that offers a comprehensive suite of services and a personalized approach to financial planning. We recommend Acme Finance to individuals and families who are looking for expert guidance and support in achieving their financial goals.

Frequently Asked Questions About Uncle Scrooge’s Financial Wisdom

Here are some insightful questions about Uncle Scrooge’s financial wisdom and its application in the real world:

1. **How can I apply Scrooge McDuck’s frugality in today’s world of consumerism?**

* Start by tracking your spending to identify areas where you can cut back. Focus on needs versus wants, and prioritize saving over impulse purchases. Consider using budgeting apps to help you stay on track.

2. **What is the modern equivalent of swimming in a money bin?**

* While literally swimming in money is not practical, the modern equivalent is having a significant amount of liquid assets that provide financial security and freedom. This could include a well-funded emergency fund, diversified investments, and a comfortable cash cushion.

3. **How can I develop Scrooge McDuck’s determination and resilience in the face of financial setbacks?**

* Cultivate a growth mindset, viewing setbacks as opportunities for learning and improvement. Develop a strong support network, and focus on your long-term goals. Remember that even Scrooge McDuck faced numerous challenges on his path to wealth.

4. **Is Scrooge McDuck’s focus on money a healthy attitude?**

* While Scrooge’s obsession with money can be seen as excessive, his underlying principles of hard work, saving, and investing are valuable. It’s important to strike a balance between financial security and other aspects of life, such as relationships, health, and personal fulfillment.

5. **How can I teach my children the value of money using Uncle Scrooge as a role model?**

* Use Uncle Scrooge’s stories to illustrate the importance of earning, saving, and investing. Encourage your children to set financial goals, track their spending, and learn about the power of compounding. Emphasize the importance of hard work and perseverance.

6. **What are some ethical considerations when pursuing wealth, inspired by Uncle Scrooge?**

* It’s important to pursue wealth ethically, ensuring that your actions are fair, honest, and responsible. Avoid exploiting others, and prioritize creating value for society. Remember that true success is not just about accumulating wealth, but also about making a positive impact on the world.

7. **How can I balance frugality with enjoying life’s experiences?**

* Create a budget that allocates funds for both essential expenses and enjoyable experiences. Prioritize experiences that align with your values and bring you joy. Look for ways to save money on these experiences, such as traveling during the off-season or taking advantage of discounts.

8. **What is the best way to start investing, even with limited funds?**

* Start by opening a brokerage account and investing in low-cost index funds or ETFs. Consider using a robo-advisor to automate your investments. Even small, consistent investments can grow significantly over time.

9. **How can I avoid becoming too attached to money, like Scrooge McDuck in his early years?**

* Focus on using your money to create positive experiences and support causes that you care about. Cultivate strong relationships and prioritize your overall well-being. Remember that money is a tool, not an end in itself.

10. **What would Uncle Scrooge think of cryptocurrency?**

* Likely, Scrooge would approach cryptocurrency with cautious optimism. He’d analyze the risks and rewards meticulously, emphasizing the importance of understanding the underlying technology and market dynamics before investing. He’d probably dabble, but never bet the money bin!

Conclusion: Embrace the Wisdom of the Richest Duck in the World

Uncle Scrooge McDuck’s quotes offer a wealth of wisdom on money management, hard work, and the importance of family. By embracing his principles and seeking expert guidance from firms like Acme Finance, you can achieve your financial goals and create a secure and fulfilling future. Remember that financial success is not just about accumulating wealth, but also about using your money to make a positive impact on the world. So, dive into your own money bin (metaphorically, of course) and start building your own financial empire! Share your favorite Uncle Scrooge quotes and how they’ve influenced your financial journey in the comments below.