Understanding Your Maximum Withdrawal Wells Fargo ATM Limit

Are you a Wells Fargo customer who needs to access cash quickly and conveniently? Understanding your **maximum withdrawal Wells Fargo ATM** limit is crucial for managing your finances effectively. This comprehensive guide will delve into the intricacies of these limits, providing you with the knowledge to optimize your cash access and avoid potential issues. We’ll explore everything from daily limits and factors that influence them to strategies for exceeding them when necessary and comparing Wells Fargo’s policies to other major banks. This article aims to be the definitive resource on this topic, providing expert insights and practical advice you won’t find elsewhere.

What is the Maximum Withdrawal Limit at a Wells Fargo ATM?

The **maximum withdrawal Wells Fargo ATM** limit is the highest amount of cash you can take out of a Wells Fargo ATM in a single day. This limit is in place for security reasons, protecting both the bank and its customers from potential fraud and theft. While the exact amount varies depending on your account type and banking history, it’s essential to be aware of your specific limit before you need to withdraw a large sum. Default limits are often set lower to provide an initial security buffer, particularly for new accounts. Knowing this limit helps you plan your cash needs effectively and avoid unexpected declined transactions.

Standard Daily Withdrawal Limits

Wells Fargo typically sets a standard daily ATM withdrawal limit. This limit can vary depending on several factors. It’s not a one-size-fits-all number. Understanding the standard range is a good starting point. However, it’s vital to confirm your specific limit through your online banking profile, the Wells Fargo app, or by contacting customer service. Having the right information ensures a smooth transaction process.

Factors Influencing Your Specific Limit

Several factors can influence your **maximum withdrawal Wells Fargo ATM**. These include:

* **Account Type:** Different account types (e.g., checking, savings, Premier Checking) often have different default limits.

* **Banking History:** Customers with a longer and more established banking history with Wells Fargo may be eligible for higher limits.

* **Customer Relationship:** The overall relationship with the bank, including other accounts and services used, can play a role.

* **Security Concerns:** If any suspicious activity is detected on your account, Wells Fargo may temporarily lower your limit as a precaution. For example, unusually large or frequent transactions might trigger a temporary security hold.

Why Do Withdrawal Limits Exist?

ATM withdrawal limits exist primarily for security. They are a crucial measure to protect customers and the bank from various risks. Understanding these protections helps appreciate the need for them.

Protection Against Fraud and Theft

The most significant reason for **maximum withdrawal Wells Fargo ATM** limits is to protect against fraud and theft. If your debit card is lost or stolen, a withdrawal limit restricts the amount of money a thief can access before you report the issue to the bank. This significantly reduces potential losses.

Preventing Unauthorized Access

Withdrawal limits also help prevent unauthorized access to your account. Even if someone obtains your PIN, the daily limit restricts the amount they can withdraw, limiting the damage from unauthorized activity. This acts as a safety net in case of compromised security.

Bank Security and Risk Management

From the bank’s perspective, ATM withdrawal limits are a part of their overall risk management strategy. By limiting the amount of cash available at ATMs, Wells Fargo reduces its potential losses from robberies or other security breaches. This is a key component of ensuring the stability and security of their banking operations.

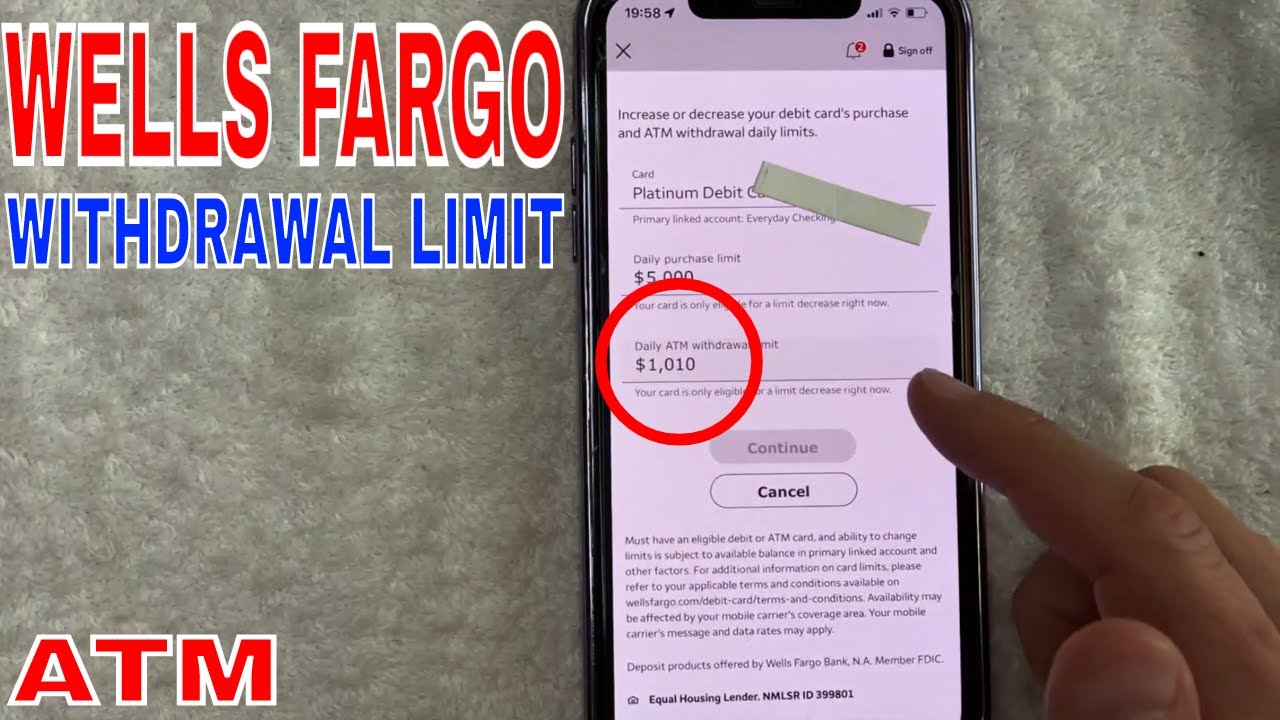

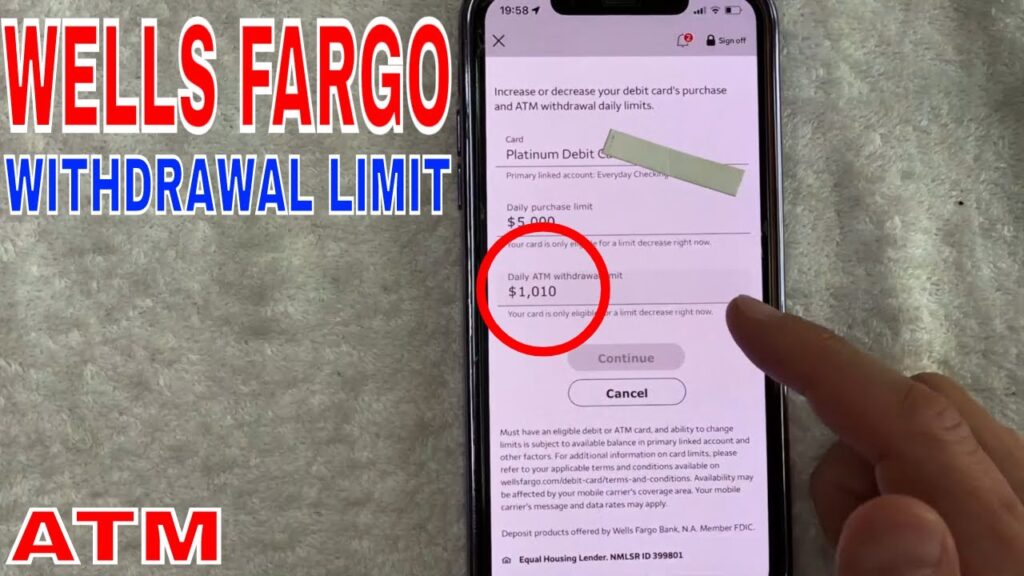

How to Check Your Wells Fargo ATM Withdrawal Limit

Knowing your **maximum withdrawal Wells Fargo ATM** limit is essential. Fortunately, Wells Fargo provides several convenient methods to check your limit.

Online Banking

The easiest way to check your withdrawal limit is through Wells Fargo Online banking. Simply log in to your account and navigate to the account settings or profile section. Your daily ATM withdrawal limit should be displayed clearly. This is a quick and accessible method available 24/7.

Wells Fargo Mobile App

The Wells Fargo Mobile app offers the same functionality as online banking. After logging in, access your account details to view your daily ATM withdrawal limit. The app provides a convenient way to check your limit on the go, right from your smartphone.

Contacting Customer Service

If you prefer to speak with a representative, you can contact Wells Fargo customer service by phone. A customer service agent can verify your identity and provide you with your current ATM withdrawal limit. This is a good option if you have any questions or need further assistance.

Visiting a Branch

You can also visit a local Wells Fargo branch to inquire about your withdrawal limit. A banker can access your account information and provide you with the details. This is a helpful option if you prefer face-to-face interaction and need personalized support.

Can You Increase Your Wells Fargo ATM Withdrawal Limit?

In some situations, you may need to withdraw more than your standard **maximum withdrawal Wells Fargo ATM** limit. Wells Fargo offers options for increasing your limit, but it’s important to understand the process and requirements.

Temporary Increase Options

Wells Fargo may allow temporary increases to your ATM withdrawal limit for specific needs. This is often granted on a case-by-case basis and may require providing documentation or explanation for the increased withdrawal. It’s best to contact Wells Fargo customer service or visit a branch to request a temporary increase.

Permanent Increase Requests

If you frequently need to withdraw larger amounts, you can request a permanent increase to your ATM withdrawal limit. This typically involves a review of your banking history, creditworthiness, and overall relationship with Wells Fargo. Approval is not guaranteed and depends on meeting specific criteria.

Requirements and Approval Process

To request an increase, you’ll likely need to provide documentation such as proof of income, identification, and a clear explanation of why you need a higher limit. Wells Fargo will then review your request and make a decision based on their internal policies and risk assessment. The approval process can take several business days. Requests are more likely to be approved if you have a long-standing relationship with the bank and a good credit history. Frequent overdrafts or other negative banking behaviors can hinder the approval process.

Alternatives to Withdrawing Cash from an ATM

If you need access to funds beyond your **maximum withdrawal Wells Fargo ATM** limit, several alternative options are available.

Cash Back at Point of Sale

Many retailers offer cash back when you make a purchase with your debit card. This allows you to withdraw a small amount of cash without using an ATM. The amount of cash back available varies by store, but it can be a convenient option for smaller cash needs.

Wire Transfers

For larger sums, a wire transfer can be a secure way to move funds. You can initiate a wire transfer from your Wells Fargo account to another account, either at Wells Fargo or another bank. Keep in mind that wire transfers typically involve fees.

Using Your Debit Card for Purchases

Instead of withdrawing cash, consider using your debit card directly for purchases. Most businesses accept debit cards, making it a convenient and secure way to pay for goods and services. This eliminates the need to carry large amounts of cash.

Writing a Check

While less common today, writing a check is still an option for making payments. You can write a check to a business or individual and avoid the need to withdraw cash. However, ensure that the recipient accepts checks as a form of payment.

Cashier’s Check

A cashier’s check is a guaranteed form of payment issued by the bank. You can obtain a cashier’s check from Wells Fargo for a specific amount and use it to make a payment. This is a secure option for large transactions.

Wells Fargo ATM Fees and Charges

While using Wells Fargo ATMs is generally free for Wells Fargo customers, it’s important to be aware of potential fees and charges.

Wells Fargo ATM Usage Fees

Wells Fargo typically does not charge its customers fees for using Wells Fargo ATMs. However, if you use an ATM that is not part of the Wells Fargo network, you may be charged a fee by the ATM owner. These fees can vary depending on the ATM operator.

Overdraft Fees

If you attempt to withdraw more money than is available in your account, you may incur an overdraft fee. Wells Fargo charges overdraft fees for each transaction that overdraws your account. It’s important to monitor your account balance to avoid overdraft fees.

Fees for Non-Customers

Non-Wells Fargo customers who use Wells Fargo ATMs may be charged a fee. This fee is typically disclosed on the ATM screen before you complete the transaction. Consider using an ATM from your own bank to avoid these fees.

Comparing Wells Fargo’s ATM Withdrawal Limits to Other Banks

It’s helpful to compare Wells Fargo’s **maximum withdrawal Wells Fargo ATM** limits to those of other major banks to understand how they stack up.

Bank of America

Bank of America’s standard ATM withdrawal limit is generally similar to Wells Fargo’s, but it can vary based on account type and customer history. Bank of America also allows customers to request temporary or permanent increases to their limits.

Chase

Chase’s ATM withdrawal limits are also in line with industry standards. Like Wells Fargo, Chase offers options for increasing your limit based on your banking relationship and needs. They also have measures in place to prevent fraud.

Citibank

Citibank’s ATM withdrawal limits are comparable to those of Wells Fargo, Bank of America, and Chase. Citibank also provides options for increasing your limit and offers various tools to manage your account and prevent fraud.

General Industry Standards

Overall, ATM withdrawal limits among major banks are relatively consistent. Most banks set limits to protect customers and themselves from fraud and theft. While the exact amounts may vary, the underlying principles are the same.

Tips for Managing Your Cash Withdrawals Effectively

Managing your cash withdrawals effectively can help you avoid issues and optimize your access to funds.

Planning Ahead

Before you need to withdraw cash, plan ahead and determine how much you need. This will help you avoid exceeding your ATM withdrawal limit. Consider using a debit card or other payment methods for larger purchases.

Monitoring Your Account Balance

Regularly monitor your account balance to ensure you have sufficient funds for your withdrawals. This will help you avoid overdraft fees and declined transactions. Use online banking or the mobile app to check your balance frequently.

Using Alternative Payment Methods

Consider using alternative payment methods such as debit cards, credit cards, or online payment services instead of withdrawing cash. This can help you reduce your reliance on ATMs and manage your finances more efficiently.

Keeping Your Debit Card Secure

Protect your debit card and PIN to prevent unauthorized access to your account. Do not share your PIN with anyone and be cautious when using ATMs in public places. Report any lost or stolen cards immediately to Wells Fargo.

Q&A: Common Questions About Wells Fargo ATM Withdrawal Limits

Here are some insightful Q&A regarding maximum withdrawals:

1. **What happens if I try to withdraw more than my daily limit?**

* If you attempt to withdraw more than your **maximum withdrawal Wells Fargo ATM** limit, the transaction will be declined, and you will not receive the cash. It’s important to know your limit to avoid this inconvenience.

2. **Can I withdraw cash from a Wells Fargo ATM using a credit card?**

* Yes, you can withdraw cash from a Wells Fargo ATM using a credit card, but it’s considered a cash advance and typically incurs fees and higher interest rates. It’s generally not recommended unless it’s an emergency.

3. **How long does it take for a temporary ATM withdrawal limit increase to be approved?**

* The approval time for a temporary ATM withdrawal limit increase can vary, but it typically takes one to two business days. It’s best to contact Wells Fargo as soon as possible to request the increase.

4. **Are there any fees for requesting an increase to my ATM withdrawal limit?**

* Wells Fargo typically does not charge fees for requesting an increase to your ATM withdrawal limit. However, it’s always a good idea to confirm with a customer service representative to ensure there are no unexpected charges.

5. **Can I withdraw cash from an ATM in another country?**

* Yes, you can withdraw cash from an ATM in another country using your Wells Fargo debit card, but you may be subject to international transaction fees and ATM surcharges. Be sure to inform Wells Fargo of your travel plans to avoid any issues with your card.

6. **What should I do if my ATM card is lost or stolen?**

* If your ATM card is lost or stolen, you should immediately report it to Wells Fargo. They will cancel your card and issue a new one to prevent unauthorized access to your account.

7. **Can I use my Wells Fargo ATM card at another bank’s ATM?**

* Yes, you can use your Wells Fargo ATM card at another bank’s ATM, but you may be charged a fee by the ATM owner. It’s generally best to use Wells Fargo ATMs to avoid these fees.

8. **How can I find the nearest Wells Fargo ATM?**

* You can find the nearest Wells Fargo ATM by using the Wells Fargo website or mobile app. Both provide ATM locator tools that allow you to search for ATMs near your current location or a specific address.

9. **What is the maximum amount of cash I can deposit at a Wells Fargo ATM?**

* The maximum amount of cash you can deposit at a Wells Fargo ATM varies depending on the ATM and your account type. It’s best to check with Wells Fargo for specific details.

10. **Does Wells Fargo offer any rewards for using my debit card at ATMs?**

* Wells Fargo does not typically offer rewards specifically for using your debit card at ATMs. However, some Wells Fargo accounts may offer rewards for overall debit card usage.

Conclusion: Optimizing Your Wells Fargo ATM Experience

Understanding your **maximum withdrawal Wells Fargo ATM** limit is a key aspect of managing your finances effectively. By knowing your limit, planning ahead, and exploring alternative payment options, you can optimize your cash access and avoid potential issues. Wells Fargo provides several convenient ways to check and potentially increase your limit, as well as manage your account to prevent overdraft fees. Remember, security is paramount, and these limits are in place to protect you and the bank from fraud and theft. We hope this comprehensive guide has provided you with the knowledge and insights you need to navigate the world of Wells Fargo ATM withdrawals with confidence. Share your experiences with Wells Fargo ATM withdrawals in the comments below, or explore our advanced guide to mobile banking for more tips on managing your finances on the go.